Key Findings

Longer-Term Receivables Matter

Sorting firms by their longer-term receivables (for example, 60-month receivables minus 12-month or 36-month) helps isolate companies with newer or growing contract portfolios. This adjustment distinguishes new business from legacy receivables.

Strong Sharpe Ratios

The signal shows promising Sharpe ratios for equal-weighted portfolios:

- Between 0.77 and 0.88 when scaled by assets

- Up to 1.0 when normalized by sales

Signal Quality

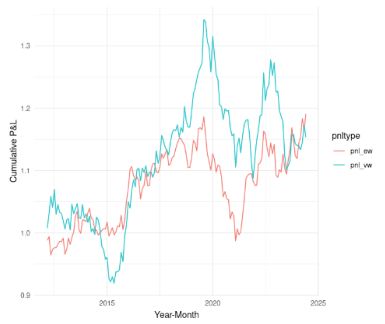

Fig. 1 and Fig. 2 illustrate the performance of portfolios sorted by adjusted receivables signals. The first chart shows the results using the 60-month minus 12-month receivables divided by sales, which delivers a Sharpe ratio of 0.77 for value-weighted portfolios and 0.88 for equal-weighted portfolios, highlighting stronger performance among smaller, less-followed companies. The second graph uses the 60-month minus 36-month approach, which refines the signal further and produces an even stronger Sharpe ratio of 1.0 for equal-weighted portfolios. Both charts demonstrate that isolating newer, longer-term government contracts can uncover underpriced equity opportunities.

Undervalued Segments

The effect is stronger for small and mid-sized firms, which aligns with the idea that these companies receive less attention from the market. Value-weighted portfolios show weaker results, reinforcing the opportunity in smaller-cap names.

|

|

Additional Methodology Notes

- Universe of Stocks Considered: US liquid stocks, defined as those trading above $5, with a market capitalization of at least $100M, and an average daily trading volume above $1 million.

- Treatment of Zero or Missing Receivables: Companies with zero or missing receivables are excluded from the analysis.

- Strategy Construction: The long/short strategy shown is long the top bucket and short the bottom bucket of the receivables-based signal.