It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 12 of our new blog series, we will present you the latest results of Booz Allen Hamilton.

Key points:

* 97% of sales made to U.S. government;

* Revenue increased 12.1% Y/Y in Q3 and 11.4% on a year-to-date basis; 10% growth expected for the full year;

* EverWatch aquisition for $444 million to contribute $180-200 million (2% of total) in fiscal 2024 sales;

* Adjusted EBITDA on track to reach $1.25 billion in 2025, 25% higher than 2023 target;

* Seasonal weakness led to Q/Q decline in backlog to $30 billion. TTM book-to-bill of 1.22 with Y/Y backlog growth of 7.9%.

Booz Allen Hamilton Latest Quarter Results Overview

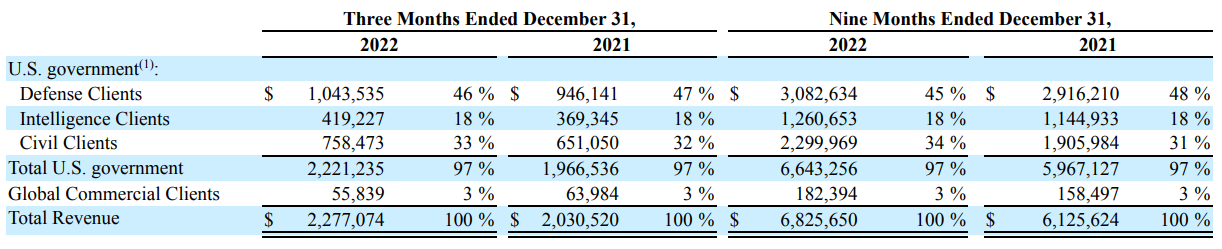

Bearing in mind that Booz Allen Hamilton’s financial year starts in April, the company reports revenues in three main customer segments, namely Defense Clients at 45.9% of Q3 2023 revenue, Intelligence Clients at 18.4% of Q3 2023 revenue and Civil Clients at 33.3% of Q3 2023 revenue:

Figure 1: Q3 2023 Booz Allen Hamilton segment revenues. (all amounts in thousands)

Source: Booz Allen Hamilton Q3 2023 Form 10-Q

Overall, 97% of sales were made to the U.S. government. A small divestment impacted the Global Commercial Clients reporting line Y/Y.

Operational Overview

Defense Clients saw revenue growth of 10.3% Y/Y in Q3, ahead of the 5.7% growth for the first 9 months of fiscal 2023.

Intelligence Clients delivered 13.5% Y/Y sales growth in Q3, an acceleration to the 10.1% in the first 9 months of fiscal 2023.

Civil Clients was the strongest division in the quarter, led by healthcare, with revenues up 16.5% Y/Y. It was also the strongest segment in the first 9 months of the year, delivering a 20.7% revenue increase.

On a consolidated basis, sales increased 12.1% Y/Y in Q3 and 11.4% on a year-to-date basis. Adjusted EBITDA was up 9.8% Y/Y in the quarter and 7.2% YTD. The Adjusted EBITDA margin was 10.7% in the quarter, below the 11.5% for the 9 months. The year-to-date margin result is some 3.4% below last year's number. Adjusted Diluted EPS was $1.07/share in the quarter, up 4.9% Y/Y, and $3.55/share YTD, up 6% Y/Y. Net cash provided by Operating Activities was 366 million YTD, down 24% Y/Y.

Regarding reported net income (-76.2% Y/Y in Q3), a charge of $124 million was recorded in the quarter relating to a potential settlement with the U.S. Department of Justice for an investigation dating back to 2017. The company estimates the $124 million as the low end of its range of probable loss.

EverWatch acquisition

As disclosed in the 10-Q report:

On October 14, 2022, the Company completed the acquisition of EverWatch Corp. (“EverWatch”), a leading provider of advanced solutions to the defense and intelligence communities for approximately $444.8 million.

EverWatch will expand Booz Allen Hamilton's capacity in the classified software space. The transaction was funded with cash on hand. Everwatch contributed $28.6 million to Q3 revenue, or 1.3% of total. BAH expects EverWatch to contribute $180-200 million (about 2% of total) in fiscal 2024 sales on a stand-alone basis.

Booz Allen Hamilton Updated 2023 Outlook

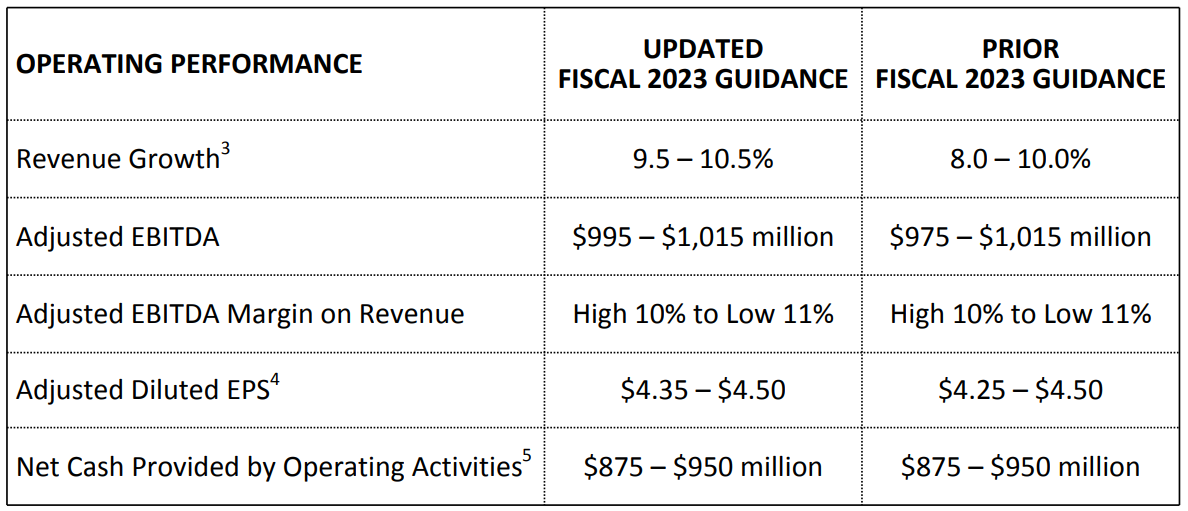

In light of accelerating business momentum, Booz Allen Hamilton boosted its 2023 guidance:

Figure 2: Q3 2023 Booz Allen Hamilton Updated Guidance

Source: Booz Allen Hamilton Q3 2023 Results Release

Revenue is now expected to increase by 10% Y/Y, implying a slowdown from both the Q3 and YTD pace (explained by one fewer working day in Q4). Adjusted Diluted EPS is now seen at about $4.43/share, again forecasting a weaker Q4 compared to the Q3 and year-to-date run-rate.

The company also used the conference call to reaffirm its 2025 goal of adjusted EBITDA of $1.2-1.3 billion, some 25% higher than the 2023 forecast:

The results of the last several quarters put us on track to achieve our adjusted EBITDA targets. On balance, we see more momentum on organic growth and profit than we originally anticipated. And while acquisitions remain a priority, the pace of M&A has been slower than we originally expected. We will continue to move strongly on both fronts in the coming quarters.

Backlog

Due to seasonal weakness and awards timing, the backlog decreased by $1.8 billion Q/Q to $30 billion, with a book-to-bill ratio of just 0.09 in the quarter. Nevertheless, the backlog is still up 7.9% Y/Y while the trailing 12-month book-to-bill is 1.22.

Capital Structure

Following the EverWatch acquisition, Booz Allen Hamilton ended 2022 with a net debt of about $2.5 billion. This compares with a market capitalization of $12.6 billion. Overall, the capital structure remains conservative. What's more, Standard & Poor's upgraded the company's credit rating to investment grade (BBB-).

Conclusion

Booz Allen Hamilton is making the necessary investments to reach its 2025 targets. Client staff is up 7.5% Y/Y and the company continues to pursue opportunistic M&A deals such as EverWatch. The backlog decline observed during the quarter is seen as a timing issue.

In light of the fact that 97% of Booz Allen Hamilton sales are to the U.S. government, monitoring public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Booz Allen Hamilton or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.