It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our Government Receivables as a Stock Market Signal white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Raytheon recently reported its Q1 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* RTX reported 12% higher Y/Y sales in Q1 2024, driven by commercial customers;

* Adjusted EPS grew 10% Y/Y to $1.34/share, helped by a 6% increase in operating profit and $12.9 billion in share buybacks in 2023;

* Backlog growth was 3% Q/Q, again buoyed by commercial customers;

* Cumulative government revenue exposure was 55% in Q1 2024, down from 59% in 2023;

* RTX kept its 2024 outlook unchanged, with Q1 2024 trends set to continue in the remainder of the year.

[Request a sample of government contracts won by Raytheon and other prominent US defense suppliers]

RTX Q1 2024 Results Overview

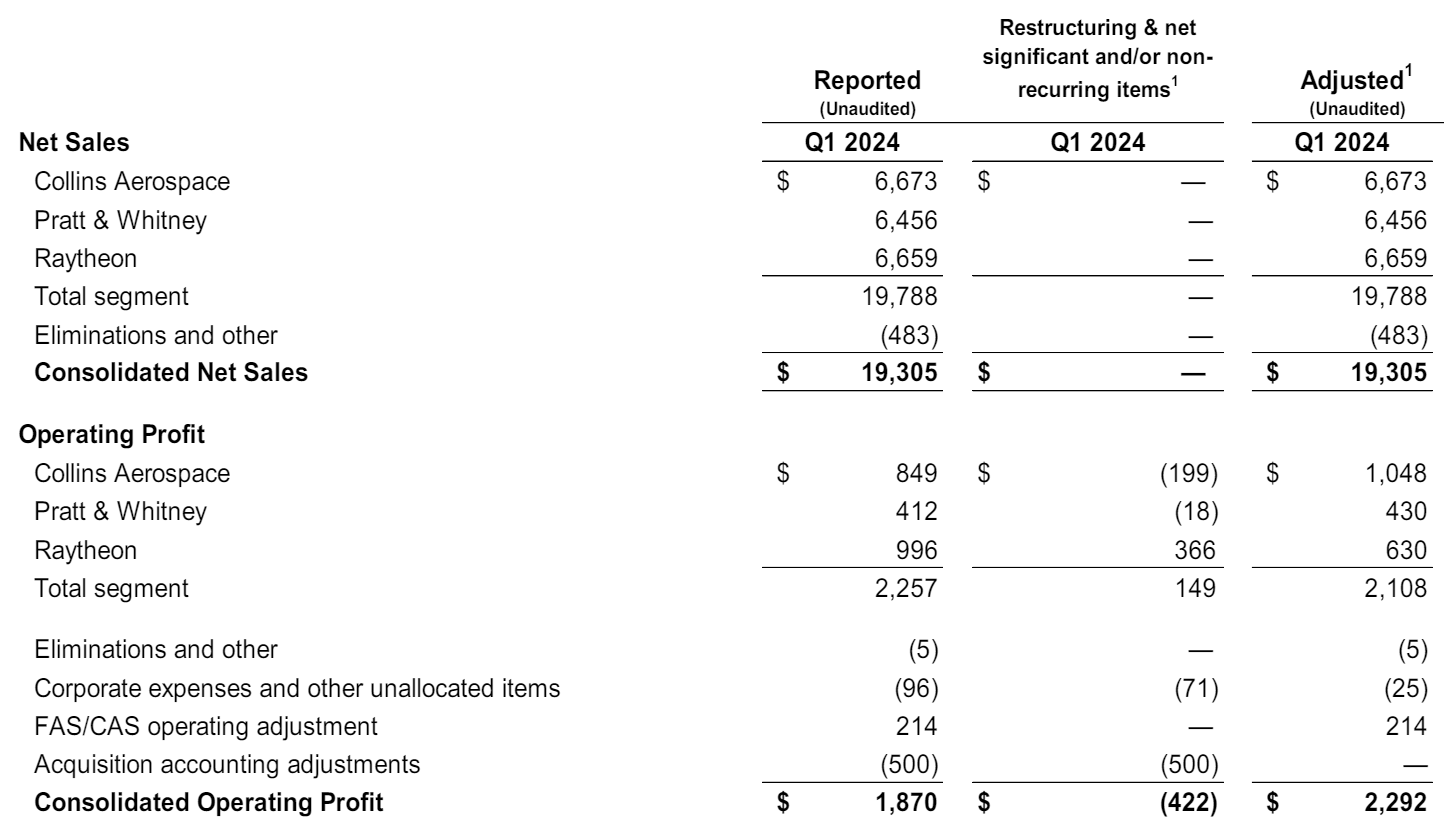

RTX reports results in three main segments of roughly equal size in terms of sales, namely Collins Aerospace, Pratt & Whitney, and Raytheon. From a profitability perspective, results are more nuanced, with Collins Aerospace accounting for 50% of Q1 2024 operating profit, Pratt & Whitney for 20%, and Raytheon for 30% of Q1 2024 operating profit:

Figure 1: Results breakdown between segments

Source: RTX Q1 2024 Results Presentation

Operational Overview

Collins Aerospace reported a 9% Y/Y increase in Q1 2024 sales, driven by commercial customers, while the defense business grew a meager 1%. The margin picture was polarized, with reported margins (12.7%) lower Y/Y on impairment charges and unfavourable purchase commitments, while adjusted margins grew to 15.7% (2023: 14.8%) on higher volumes. As a result, adjusted operating profit grew 16% Y/Y.

Pratt & Whitney was the fastest growing segment in Q1 2024, increasing sales at 23% Y/Y, driven by commercial customers, while the defense business grew 21%. Margin performance was notably bleak, down on a reported and adjusted basis, impacted by higher research and development, as well as sales and administrative expenses. With an adjusted margin of 6.7% (2023: 8.3%), operating profit slipped 1% Y/Y.

Raytheon was the slowest growing segment in Q1 2024, recording a 6% increase in sales, driven by higher volumes on land and air defense systems. Reported margins benefitted from a gain on the sale of the Cybersecurity, Intelligence, and Services business, while adjusted margins increased 0.2% Y/Y to 9.5% on higher volumes.

On a consolidated basis, RTX revenue increased 12% in Q1 2024 (2023: +3%), while adjusted EPS increased 10% Y/Y to $1.34/share (2023: $5.06/share), driven by a 6% Y/Y increase in Q1 2024 adjusted operating profit. Free cash flow was negative in Q1, at $125 million (2023: $5.5 billion). Combined defense sales increased 7% year-over-year in Q1.

2024 Outlook

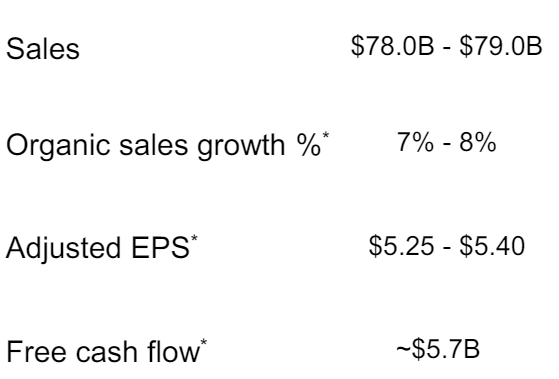

With Q1 results largely in line with the company’s expectations, RTX reaffirmed its initial 2024 outlook:

Figure 2: Unchanged 2024 RTX Outlook

Source: RTX Q4 2023 Results Presentation

In 2024, the company expects:

- Sales are set to grow 14% in 2024

- Adjusted EPS is seen 5% higher in 2024

- Free cash flow is forecast to grow 4% relative to 2023

Capital Structure

RTX ended Q1 2024 with a net debt of $37.2 billion, a conservative amount relative to the $135 billion market capitalization. That said, net debt is up significantly relative to the prior-year quarter ($28.6 billion), largely due to $12.9 billion in stock repurchases in 2023. Current buyback activity is more muted, at just $56 million in Q1 2024.

Backlog Developments

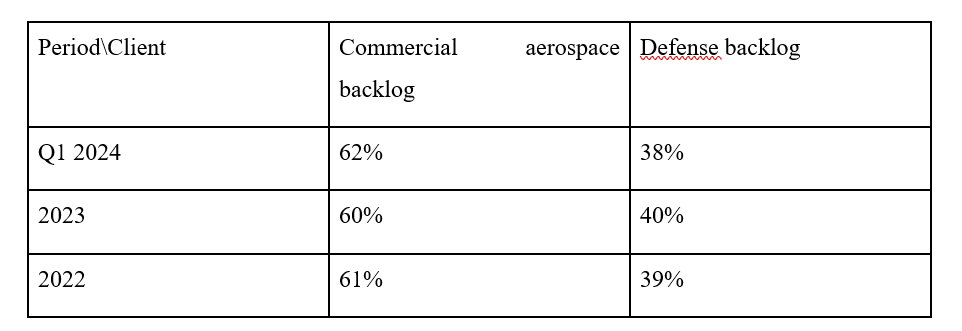

Raytheon’s results look particularly impressive given that the company managed to grow its backlog by 3% Q/Q to a record $202 billion (book-to-bill ratio of 1.34), driven by the commercial business, as defense backlog actually declined by 1% during the first quarter of 2024. As a result, commercial aerospace accounted for 62% of the total company backlog, leaving 38% for the defense backlog:

Figure 3: RTX backlog split between commercial aerospace and defense, 2022-Q1 2024

Source: Author calculations based on company disclosure

As per the company’s Q1 2024 results press release, notable defense booking during the quarter included:

- $1.6 billion of classified bookings at Raytheon

- $1.2 billion for Germany Patriot production at Raytheon

- $1.7 billion for GEM-T production at Raytheon

- $282 million for Ukraine NASAMS production at Raytheon

Government Contracts Exposure

RTX provided a detailed breakdown of its customers in the company’s 10-Q report for Q1 2024, showing the increased importance of commercial sales (45% of total revenue) and declining U.S. government exposure (42%) at the start of 2024:

Figure 4: RTX customer breakdown 2022-Q1 2024

Source: Author calculations based on company disclosure

We observe that cumulative government exposure was 55% of RTX’s revenue in Q1 2024, down from 59% government exposure in 2023. This trend has been in place for several years, with government orders accounting for 65% of the company’s top line as recently as 2021.

Conclusion

RTX delivered 12% revenue growth in Q1 2024, driven by the commercial side of the business, with military sales increasing 7% Y/Y. Backlog growth was impressive as well, at 3% Q/Q, although there the strength was concentrated purely in commercial orders. Looking ahead, the company expects the rapid sales growth pace to continue throughout the year, with margins and higher interest expense a marginal drag on adjusted EPS and free cash flow growth, which are forecast to increase at half the pace of sales growth.

Even after the recent uptick in commercial sales, combined government orders still account for a total of 55% of RTX’s topline.

In light of the fact that government customers make up more than half of Raytheon's revenue, monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

To get a free sample of the government contracts awarded to Raytheon and other established government suppliers, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Raytheon or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.