It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In the seventh article of our new blog series, we will present you the latest results of IBM.

Key points:

* Flat Y/Y revenues in Q4 and 5.5% increase in 2022, overcoming substantial currency headwinds;

* Margin expansion observed in Q4 set to continue in 2023 driven by higher sales and fading currency drag;

* Software and Consulting segments to drive revenue and margin growth in 2023;

* $9.3 billion in free cash flow for 2022 vs. $6.5 billion in 2021. Target for 2023 set at $10.5 billion;

* Net debt down $2 billion to $42.1 billion. 25.3% of total debt is held in IBM Financing.

IBM Q4 2022 Results Overview

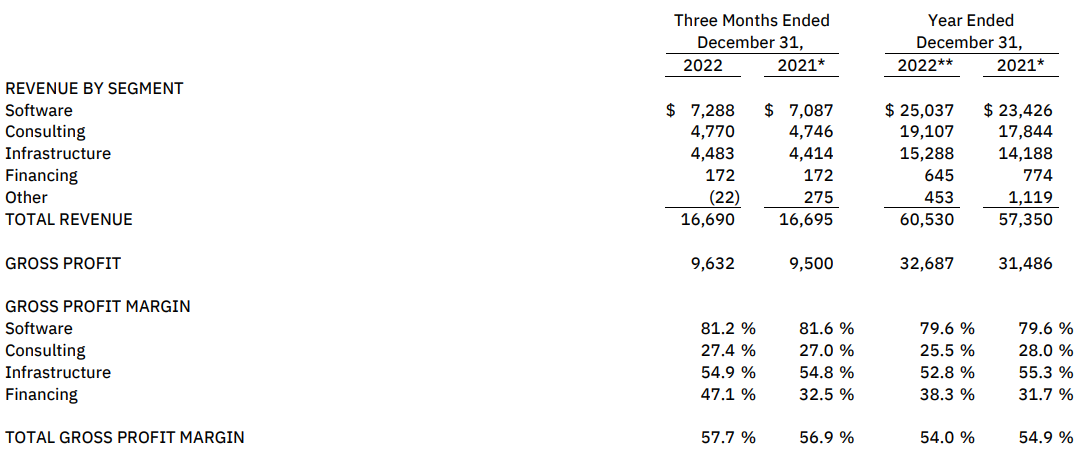

IBM reports results in three main segments, namely Software (includes Hybrid Platform & Solutions, Transaction Processing) at 43.7% of Q4 2022 revenues, Consulting (includes Business Transformation, Technology Consulting and Application Operations) at 28.6% of Q4 2022 revenues and Infrastructure (includes Hybrid Infrastructure and Infrastructure Support) at 26.9% of Q4 2022 revenues:

Figure 1: IBM Q4 Results by Segment

Source: IBM 2022 Q4 Results Press Release

Operational Overview

Software delivered 2.8% Y/Y revenue growth in Q4, below the 6.9% increase for 2022. The gross profit margin was 81.2% in Q4, down Y/Y but up from the 79.6% in 2022.

Consulting revenue was up only 0.5% Y/Y in Q4, well below the 7.1% increase in 2022. On a brighter note, the gross profit margin of 27.4% in Q4 improved both Y/Y, as well as relative to the 25.5% in 2022.

Infrastructure saw sales increase 1.6% Y/Y in Q4, again below the 7.8% increase 2022. Drawing parallels with other segments, the margin expansion story continued, reaching 54.9% in Q4, markedly higher than the 52.8% for 2022.

On a group level, sales were flat Y/Y in Q4 due to slightly negative revenues in the miscellaneous Other segment. For the full year the increase was 5.5% (around 11.8% in constant currency):

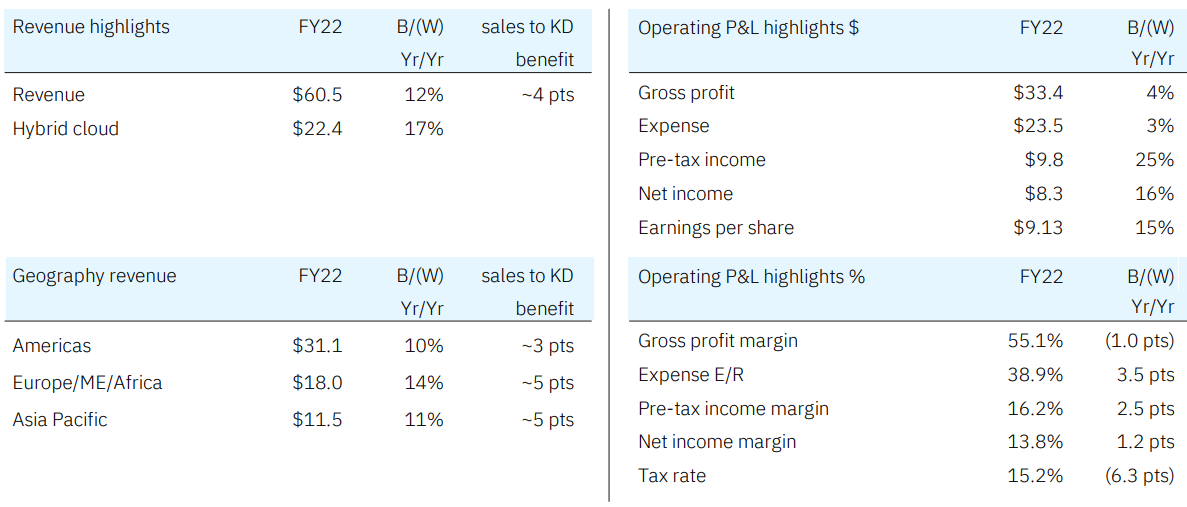

Figure 2: IBM 2022 Result Highlights

Source: IBM 2022 Q4 Results Presentation

Despite gross profit margin improvements in Q4 to 57.7%, the full year figure of 54% was below the 54.9% achieved in 2021 (driven largely by Russia exit and foreign exchange headwinds). Free cash flow was $5.2 billion in Q4 and $9.3 billion for the full year, up from $6.5 billion in 2021. Earnings per share were $3.60 in Q4, up 7% Y/Y. For the full year EPS were $9.13/share, up 15% Y/Y.

2023 Outlook

Revenue Growth: IBM expects constant currency revenue growth consistent with its mid-single digit model. At current foreign exchange rates, the company expects currency to be neutral to a one percentage point tailwind to revenue growth (in 2022 currency was a negative contributor at 6.3%).

Across divisions the outlook is:

Software: Mid-single digit revenue increase (continued momentum in recurring revenue stream in both hybrid platform and solutions and transaction processing). Pre-tax margin to expand by about 2% year-to-year.

Consulting: High single-digit revenue (strong book-to-bill ratio). Pre-tax margin up by at least 1%.

Infrastructure: Flat revenue and low teens pre-tax margin (2022 14.8%).

Overall, IBM's pretax margin expected to expand by 0.5% (in 2022 it was 16.2%).

Free Cash Flow: The company expects about $10.5 billion in consolidated free cash flow, up more than $1 billion year to year.

IBM Revenue resilience

The Software segment ended the year with 13.3 billion in annual recurring revenue (53.2% of total 2022 revenue), up 7% Y/Y in constant currency.

In Consulting the book-to-bill ratio was 1.1 for the year.

Capital Structure

Over the course of 2022, net debt improved by $2 billion to $42.1 billion. Against a market capitalization of about $122.5 billion IBM remains one of the more levered technology companies, notwithstanding that 25.3% of total debt is held in IBM Financing (the unit facilitates IBM clients’ acquisition of information technology systems, software and services through its financing solutions).

The consistent growth profile and strong free cash flow generation make the debt position manageable. Furthermore, the company's 4% 2042 bonds currently yield around 5.4% and are a good avenue for capital deployment.

Management focus remains on organic and inorganic growth, as well as the dividend:

“In terms of cash uses for the year, we invested $2.3 billion to acquire eight companies across software and consulting, mitigated by over $1 billion in proceeds from divested businesses, and we returned nearly $6 billion to shareholders in the form of dividends.”

Source: IBM 2022 Q4 Conference Call

Conclusion

IBM is enjoying strong business momentum, driven by rising sales and an improving margin outlook. The debt position is elevated but well-contained thanks to strong free cash flow generation.

Monitoring future revenue developments will be key to assess the sustainability of IBM's revenue turnaround, given the mixed history of the company in this regard.

Considering the substantial business IBM does with government agencies, monitoring public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy IBM or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.