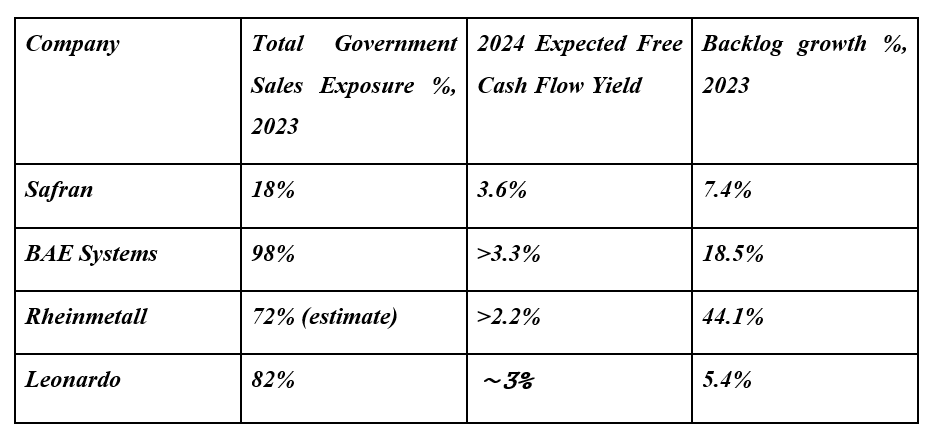

The war in Ukraine has resulted in a meaningful boost to defense spending in Europe, as shown in the figure below which highlights the amount spent by NATO countries in 2023:

Figure 1. Defense spending by NATO countries in 2023 as a percentage of GDP

Source: NATO 2023 Annual Report

Looking at the figure, we can observe that the United States and Croatia are the only two countries to register a defense spending drop in 2023 relative to 2014 levels.

Reading through the NATO 2023 Annual report, we see that “European Allies and Canada increased defence spending for the ninth consecutive year. Defence spending increased by 11% in real terms compared to 2022.

In 2023, 11 Allies met the guideline of spending 2% of their GDP on defence and in early 2024 this number increased to 18 – this, in contrast, to only three Allies meeting the guideline in 2014.

The United States accounted for 53% of the Allies’ combined GDP and 67% of combined defence expenditure. Total NATO military spending in 2023 is estimated to have been around USD 1.1 trillion.”

To investigate some of the companies benefitting from the increased defense spending, in this article, we analyze four of the largest defense suppliers in Europe - Safran, BAE Systems, Rheinmetall, and Leonardo with respect to their 2023 annual results and the significance of government contracts for their revenue.

We have already performed a similar analysis of defense suppliers to the US federal government, which you can read here.

Safran (Euronext: SAF)

Safran 2023 Results Overview

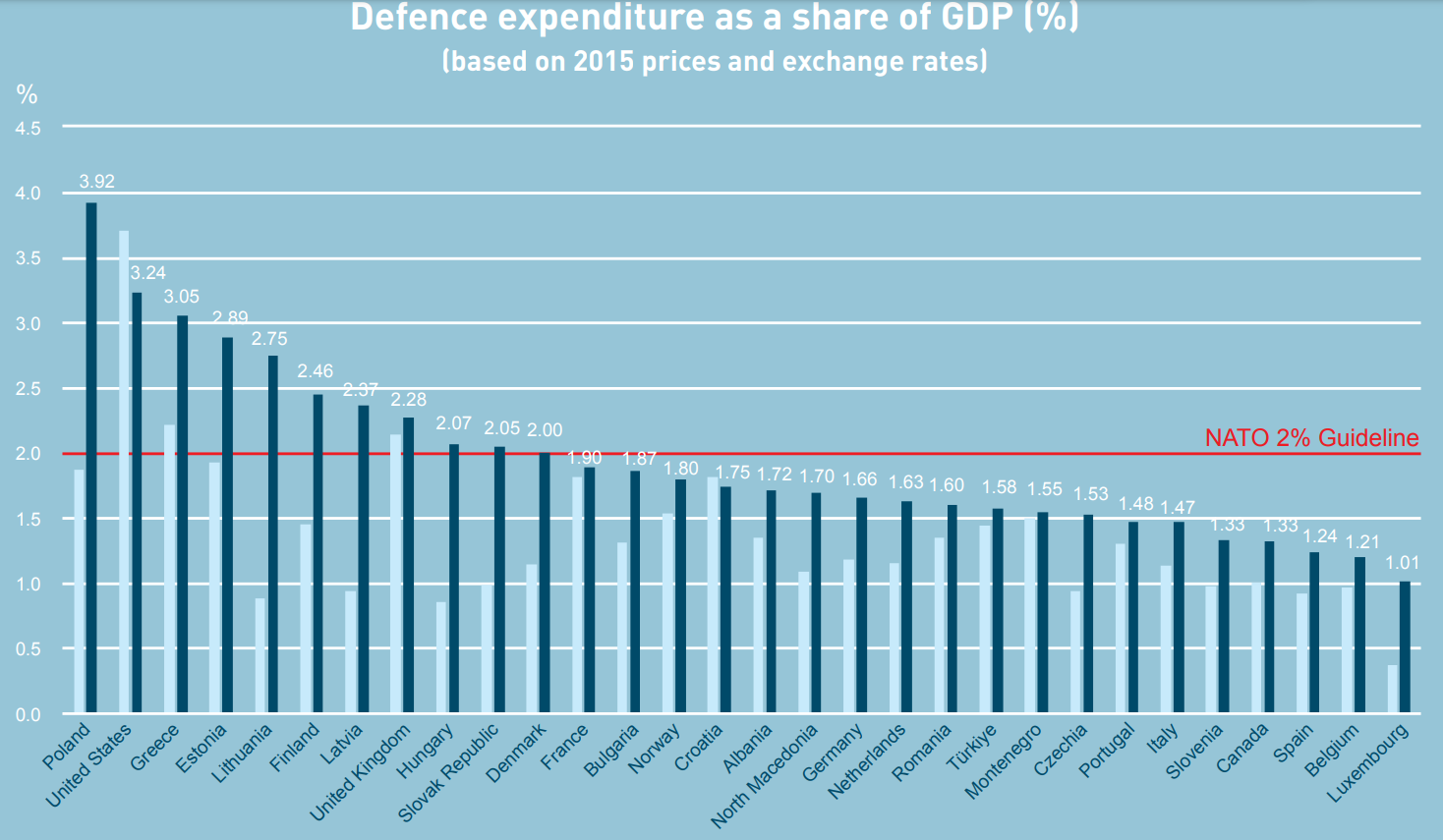

Safran reports results in three key segments, namely Aerospace Propulsion at 51% of 2023 revenues, Equipment & Defense at 38%, and Aircraft Interiors at 11% of 2023 revenue:

Figure 2. Safran 2023 Segment Results

Source: Safran 2023 Universal Registration Document

Safran recorded a 21.9% Y/Y increase in sales in 2023, with all businesses recording a double-digit increase. The strong top-line result was accompanied by higher operating margins (13.6% in 2023 vs 12.6% in 2022), resulting in a 31.5% jump in operating income.

Safran boasts an €84 billion market capitalization and runs an extremely conservative debt-free balance sheet, with a net cash position of €0.4 billion at the end of 2023. Free cash flow was €2.9 billion in 2023, up 10% Y/Y.

Turning to the 2024 outlook, the company expects 18% higher sales, a 25% stronger operating income, but only a 3% increase in free cash flow.

Safran Government Revenue Share

Safran has exposure to government contracts primarily through the supply of engines and systems to fighter jets as well as military helicopters. In 2023, military businesses accounted for about 18% of Safran’s revenue, down from the 21% contribution observed in 2022.

BAE Systems (London Stock Exchange: BA)

BAE Systems 2023 Results Overview

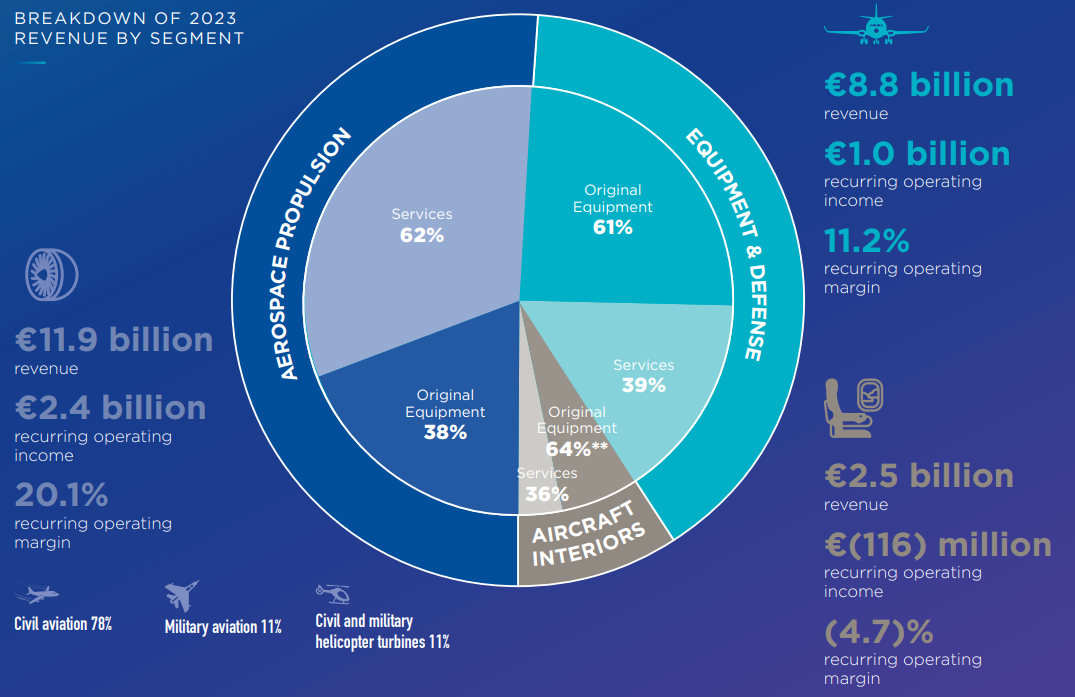

BAE Systems reports results in five main segments, namely Air at 32% of 2023 revenues, Electronic Systems at 23%, Maritime at 23%, Platforms & Services at 15%, and Cyber & Intelligence at 9% of 2023 sales:

Figure 3. BAE revenue breakdown between sectors and regions

Source: BAE Systems 2023 annual report

BAE recorded a 9% Y/Y sales increase in 2023 as all business segments contributed to the top-line growth, led by Maritime with a 20% increase. The margin performance was less robust, with the key return on sales measure at 10.6% in 2023 (2022: 10.7%), resulting in an 8% increase in 2023 operating profit.

BAE Systems has a market capitalization of £39 billion and a net debt position of £1 billion. In 2023, free cash flow came in at £2.6 billion, up 33% Y/Y.

Looking ahead, the company expects the broad-based growth to continue, with revenue gains shifting to the high-margin Electronic Systems segment. As a result, BAE expects 11% sales growth and a 12% increase in EBIT in 2024. Free cash flow is forecast at above £1.3 billion.

BAE Systems Government Revenue Share

The U.S. government was the single largest customer of BAE systems, accounting for 68% of the company’s 2023 sales. The UK and other governments drove another 30% of sales. As a result, the cumulative government revenue exposure of BAE Systems was 98% in 2023.

Rheinmetall (Deutsche Boerse: RHM)

Rheinmetall 2023 Results Overview

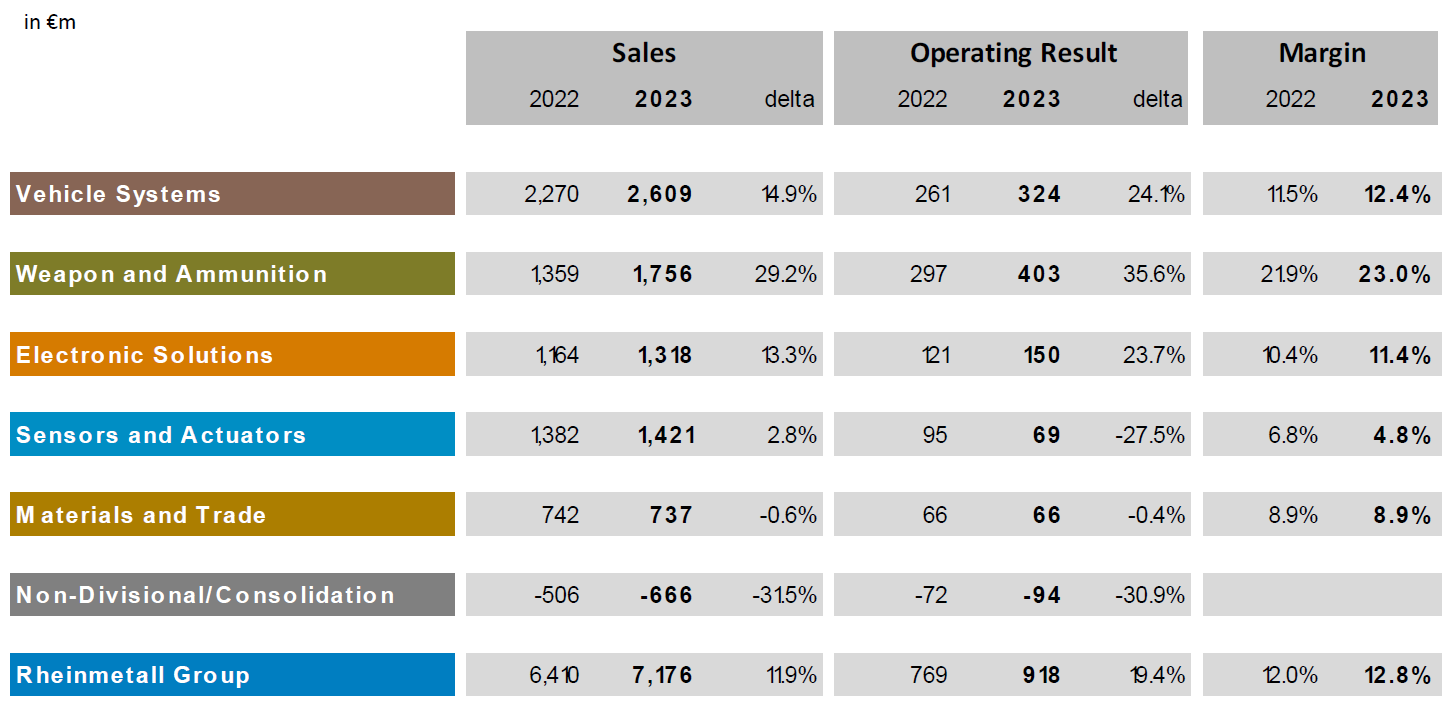

Rheinmetall reports results in five main segments, namely Vehicle Systems at 33% of 2023 sales, Weapon and Ammunition at 22%, Electronic Solutions at 17%, Sensors and Actuators at 18%, and Materials and Trade at 10% of 2023 sales:

Figure 4. Rheinmetall results breakdown between segments

Source: Rheinmetall 2023 Results Presentation

Starting in 2024, the civilian business of Rheinmetall, previously largely reported in Sensors and Actuators and Materials and Trade business segments, will be combined into a new Power Systems division.

Rheinmetall delivered 11.9% Y/Y revenue growth in 2023, driven by double-digit gains in Weapon and Ammunition, Vehicle Systems, and Electronic Solutions segments. The stellar topline performance was accompanied by margin expansion (operating margin increased to 12.8% from 12% in 2022), resulting in a 19.4% increase in operating profit.

Rheinmetall has a market capitalization of €22.7 billion and a net debt of €1.1 billion. The company now targets a new cash flow measure, the cash conversion rate, measured as a percentage of operating profit. In 2023, it stood at 38.8%, or an operating free cash flow of €356 million.

Turning to 2024, the company expects 40% sales growth with strength across business segments. Furthermore, the explosive revenue growth is set to come with continued margin expansion, with an operating margin of about 14.5%, improving the cash conversion rate to about 40%.

Rheinmetall Government Revenue Share

Rheinmetall does not disclose the exact amount of revenue derived from government customers. That said, a good approximation can be derived by observing that the new Power Systems division encompassing civilian businesses accounted for 28% of Rheinmetall’s 2023 revenue. As a result, we estimate governments accounted for 72% of Rheinmetall sales in 2023, with the significance of government contracts set to increase dramatically in 2024, since military businesses are forecast to grow 30-65% in 2024, compared to only 5% for the civilian business.

Leonardo (Euronext: LDO)

Leonardo 2023 Results Overview

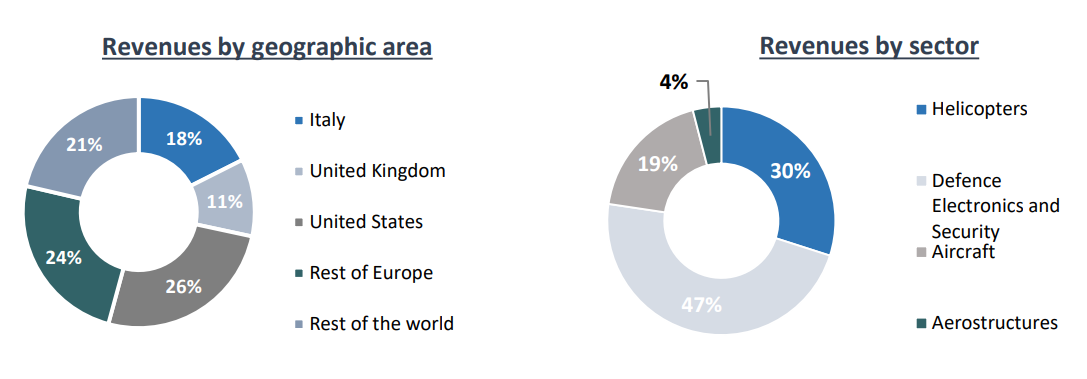

Leonardo reports results in four main sectors, namely Defense Electronics & Security at 47% of 2023 revenue, Helicopters at 30%, Aircraft at 19%, and Aerostructures at 4% of 2023 revenues:

Figure 5. Leonardo revenue by segment and geography

Source: Leonardo 2023 Annual Report

In 2023 Leonardo recorded a 3.9% Y/Y increase in sales, with gains in all segments except Aircraft. The margin profile improved as well (return on sales margin of 8.4% vs 8.3% in 2022) which drove EBITA 5.8% higher in 2023.

Leonardo boasts a €12.4 billion market capitalization and net debt of €2.3 billion. Free operating cash flow, which excludes Aerostructures investments, increased 17.8% Y/Y to €653 million.

Leonardo expects 5% topline growth in 2024, 7,7% EBITA growth, and another 18.5% increase in operating free cash flow.

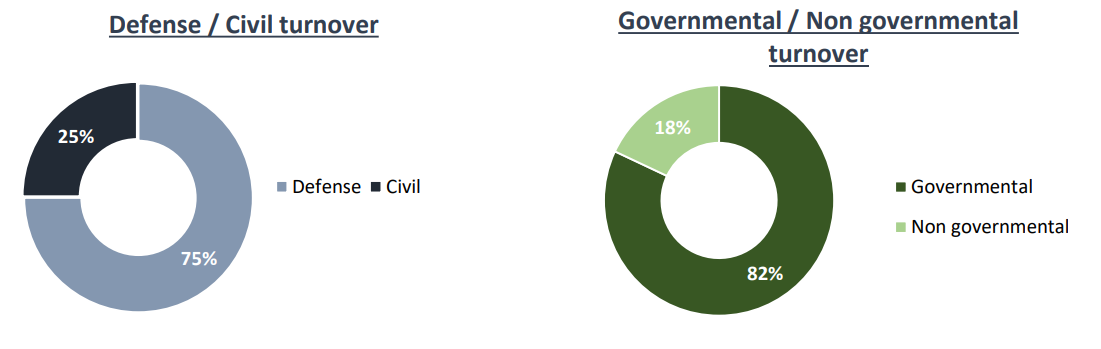

Leonardo Government Revenue Share

Leonardo derived 82% of its revenue from government sources in 2023. The company’s government exposure is largely thanks to the defense sector, with 75% of Leonardo’s revenue coming from it:

Figure 6. Leonardo revenue by customer type

Source: Leonardo 2023 Annual Report

Defense Sector Peer Analysis

After lackluster growth in the previous decade, the defense sector is poised for a comeback in the years to come. Against the backdrop of persistent geopolitical tensions, European governments have meaningfully boosted their spending on defense.

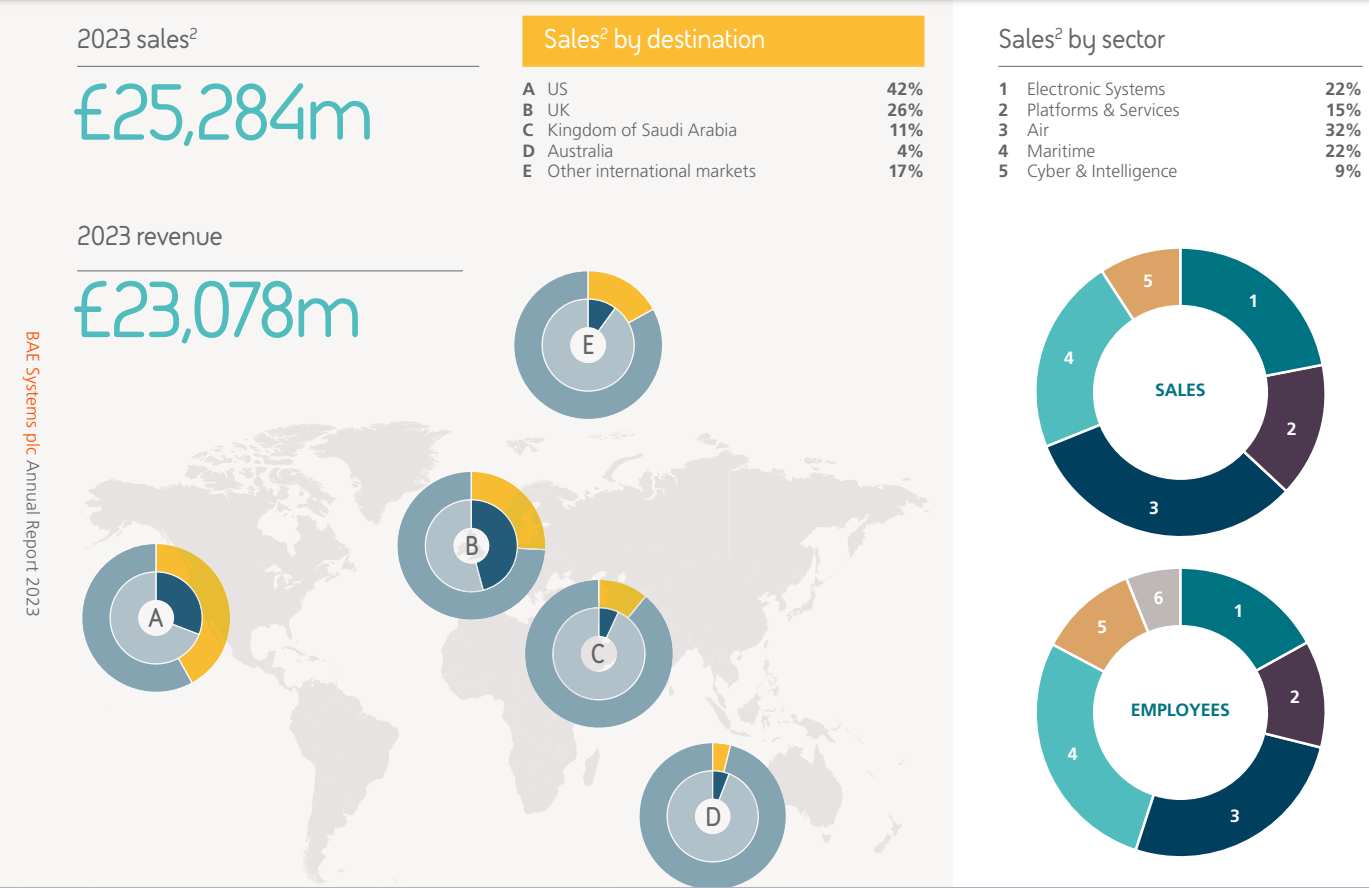

In the table below, we present key figures about the four companies in our analysis:

Figure 7: Defense Suppliers Government Sales Share out of Total Sales (2023)

Source: Company annual reports & presentations for 2023

As shown in Figure 7, three companies rely heavily on government sales while Safran is the most exposed to commercial customers, with only 18% of sales coming from government contracts. Safran is also the only company to issue a specific free cash flow outlook for 2024, with the remaining three companies offering less precise guidance.

Nevertheless, we can observe from the low single-digit free cash flow yields that the market clearly expects further growth for the four companies beyond 2024.

Looking at backlog growth, Leonardo is somewhat of an outlier, with heavy government sales exposure but the weakest backlog growth, below that of Safran.

In contrast, BAE Systems and Rheinmetall delivered double-digit backlog increases in 2023. Rheinmetall’s stellar 44.1% backlog increase in 2023 is forecast to translate into 30-65% sales growth in government-dependent businesses in 2024. This rapid growth partly explains Rheinmetall’s lowest free cash flow yield among the four companies.

The ever-growing increase in defense spending across Europe will inevitably result in higher government spending on military contracts. To be the first to know about the latest defense contracts awarded in Europe, check out our daily-updated Government Contract Awards Feed.