It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Honeywell recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance between January and March of this year.

Key points:

* The Defense and Space division, part of the Aerospace segment, accounted for 12.9% of Q1 revenue, primarily from government orders;

* Revenue up 5.8% Y/Y in Q1. Full-year outlook increased, now seen +3.9% higher;

* Adjusted EPS up 8.4% Y/Y to $2.07/share in Q1. Full-year growth expected at 4.2%, or $9.13/share;

* Compressor Controls purchase for $670 million to boost the second-largest Performance Materials and Technologies segment;

* R&D spending to continue at 4-5% of sales. Buybacks to reduce share count by at least 1% annually.

Honeywell Q1 2023 Results Overview

We originally covered Honeywell's Q4 results in part 17 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 2023.

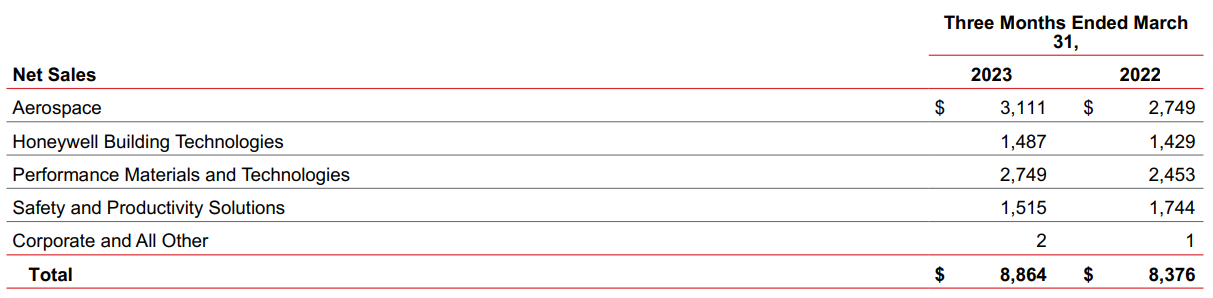

Honeywell reports results in four main segments, namely Aerospace at 35.1% of Q1 2023 revenues, Honeywell Building Technologies at 16.8%, Performance Materials and Technologies at 31% and Safety and Productivity Solutions at 17.1% of Q1 2023 revenues:

Figure 1: Q1 2023 Honeywell segment revenues

Source: Honeywell Q1 2023 Earnings Release

Operational Overview

Aerospace delivered the strongest performance in the quarter, with revenue up 13.2% Y/Y in Q1 (2022 +7.3%). The outperformance was due to higher volumes in the Commercial Aviation Aftermarket division, while the Defense and Space sub-segment benefited from higher pricing. Margins could not keep up with sales growth, resulting in 9.8% higher segment profit.

The Defense and Space division is the main public procurement dependent business of Honeywell. In Q1 2023, it accounted for 12.9% of total sales, marginally down from 13.2% in the prior-year quarter.

Honeywell Building Technologies (HBT) grew sales 4.1% Y/Y in Q1 (2022 +8.3%), with growth heavily impacted by foreign currency translation (-5%). The silver lining was definitely margins, with segment profit growing 11.6% Y/Y in Q1. Results were driven by higher sales volumes in building projects and services in the Building Solutions sub-segment, while organic sales growth in the Products sub-segment was offset by FX translation.

Performance Materials and Technologies (PMT) was the second-best performing segment, delivering 12.1% Y/Y sales growth in Q1 (2022 +7.1%). Margins were marginally weaker than sales, resulting in 11% higher segment profit. The Process Solutions division was the top performer, benefiting from increased demand in projects and smart energy.

Safety and Productivity Solutions (SPS) delivered very weak results, with revenue down 13.1% Y/Y in Q1 (2022 down 11.6%). Margin improvement was noticeable, resulting in a 2.8% higher operating profit. All divisions were down Y/Y, with Warehouse and Workflow Solutions the worst performer, hampered by lower demand for projects.

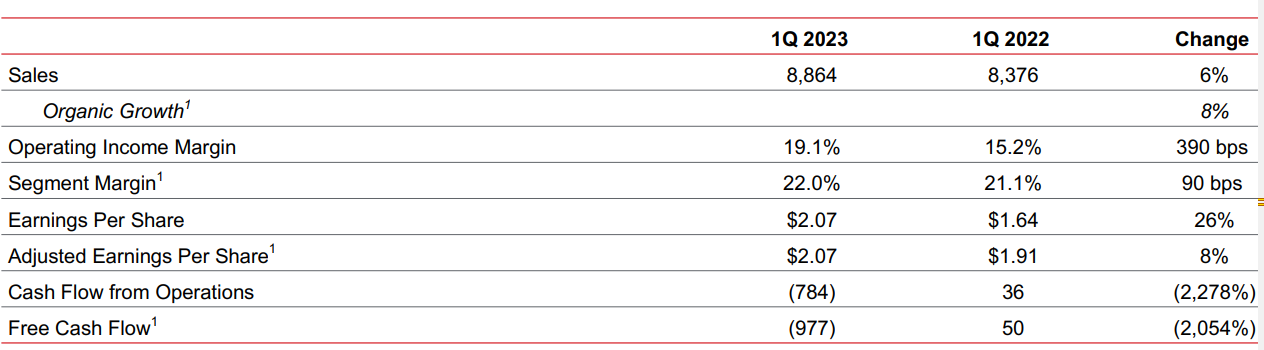

On a consolidated basis, revenue increased 5.8% in Q1 (2022 +3.1%). Adjusted EPS increased 8.4% Y/Y to $2.07/share in Q1 ($8.76/share in 2022). Free cash flow was negative at -$1 billion (2022 $4.9 billion). Excluding the $1.3 billion legacy settlements (related to asbestos and Petrobras in Brazil), free cash flow would have been positive at $0.3 billion. The segment margin improved by 0.9% to 22% in Q1 (2022 21.7%):

Figure 2: Q1 2023 Honeywell consolidated results

Source: Honeywell Q1 2023 Earnings Release

Honeywell 2023 Outlook

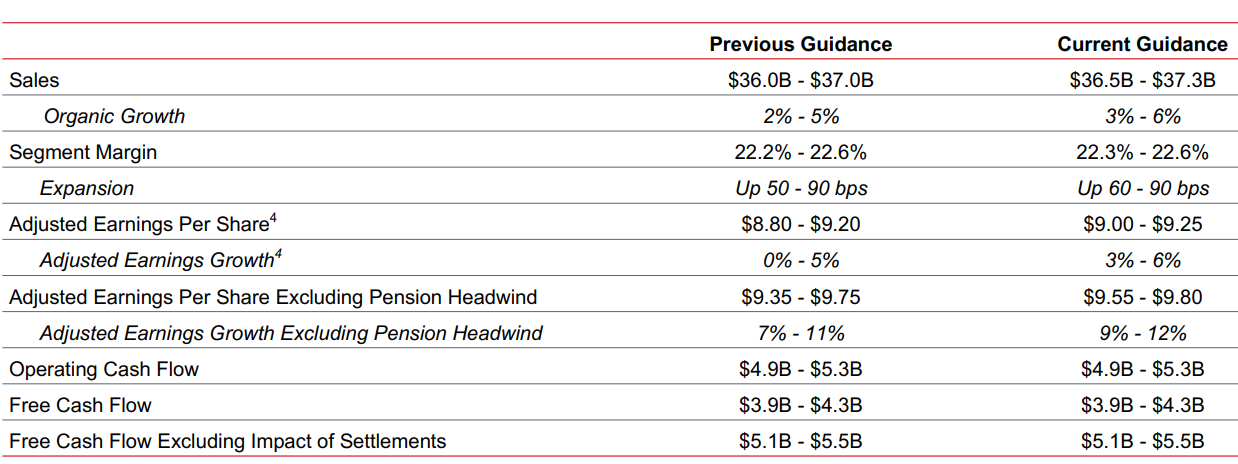

Given the stronger than expected start of the year, Honeywell boosted its top-and-bottom-line guidance, while keeping free cash flow expectations intact:

Figure 3: Honeywell Updated 2023 Outlook

Source: Honeywell Q1 2023 Earnings Release

Adjusted EPS is now expected to increase by about 4.2%, driven by higher revenues (+3.9%) and margins (+0.75%).

Backlog

Honeywell ended Q1 with a record backlog of $30.3 billion, up 6% Y/Y. Growth was driven primarily by Aerospace, which was also the main contributor to the increased 2023 guidance.

Capital Structure

Honeywell's net debt position at the end of Q1 was about $8.4 billion, very conservative against its $135 billion market capitalization.

In Q1, the company spent $0.7 billion on share buybacks.

2023 Investor Day

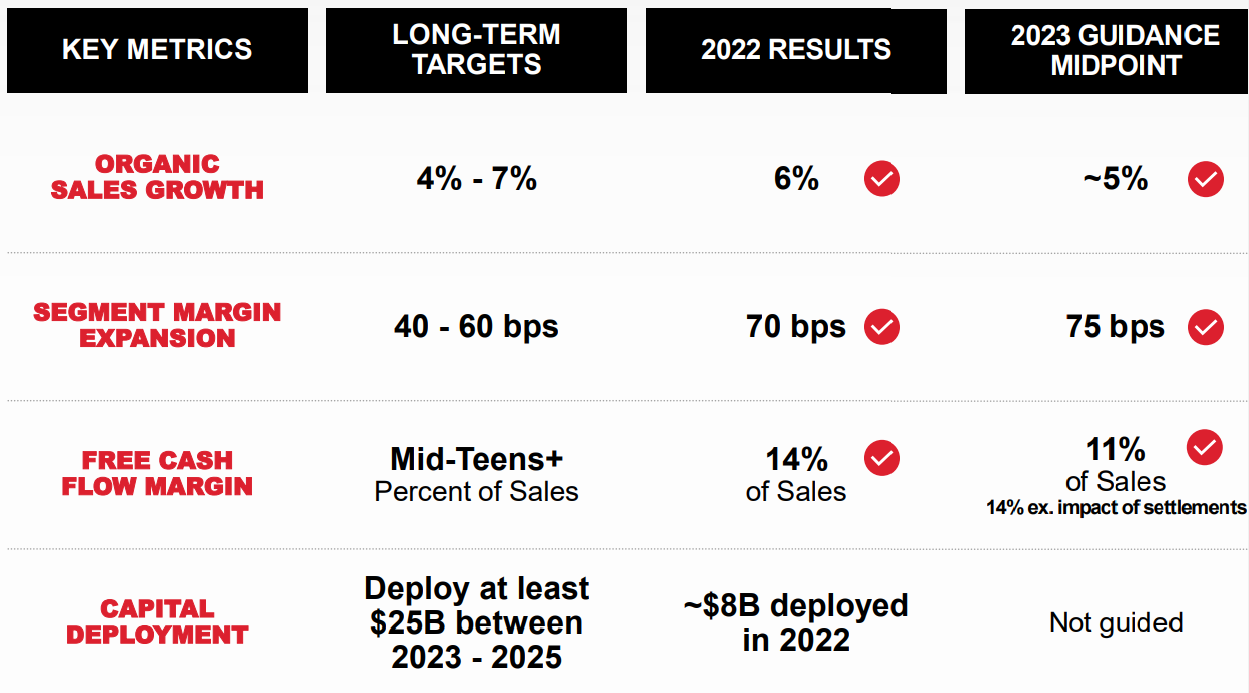

Post quarter end, on May 11, Honeywell held its Investor Day. Here are our key takeaways:

- R&D spending to continue at 4-5% of sales;

- 4-7% organic sales growth expected long-term;

- Free cash flow margin expected in the mid-teens+;

- Buybacks to reduce share count by at least 1% annually.

Figure 4: Honeywell long-term targets

Source: Honeywell Investor Day Presentation

Compressor Controls purchase

Post quarter end, on April 22, Honeywell entered into a purchase agreement to acquire Compressor Controls Corporation, a turbomachinery services and controls company based in the United States, for $670 million in cash. The business will be included in the Performance Materials and Technologies reportable business segment. The acquisition is subject to customary regulatory approvals and is expected to close in the second half of 2023.

Conclusion

Honeywell runs a very conservative balance sheet in a growing market, deploying capital for selective M&A to supplement its product offering. This lays a solid foundation for the company to achieve its 4-7% organic growth target with a low level of risk.

Legacy settlements will result in a temporarily weaker free cash flow margin in 2023 (about 11%). However, cash conversion should recover materially starting in 2024, with a trajectory to reach the company's mid-teens+ aspiration.

Honeywell's government business is primarily conducted through the Aerospace segment, specifically the Defense and Space business. Given its 12.9% contribution to the company's sales, monitoring the Honeywell’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Honeywell or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.