It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. General Electric recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

Key points:

* Military aircraft engine sales accounted for 7% of Q1 revenue. Government procurement exposure through aircraft services and grids business as well;

* 14% Y/Y revenue growth in Q1, driven by Aerospace (+25%). High single digit growth rate expected in 2023;

* EPS and free cash flow guidance low end range boosted by around 6%. EPS seen at $1.70-2.00/share (+240% Y/Y) while free cash flow expected at $3.4-4.2 billion (+23% Y/Y);

* Net debt of $10.4 billion. AerCap and GE HealthCare stakes worth around $11.8 billion to be sold over time;

* Similar growth rates at both GE Aerospace and GE Vernova long term. However, GE Aerospace to deliver a twice higher operating profit margin.

General Electric Q1 2023 Results Overview

We originally covered General Electric's Q4 2022 results as part 3 of our Top Government Contractors series here. Below we will highlight the progress achieved by GE in Q1 of 2023.

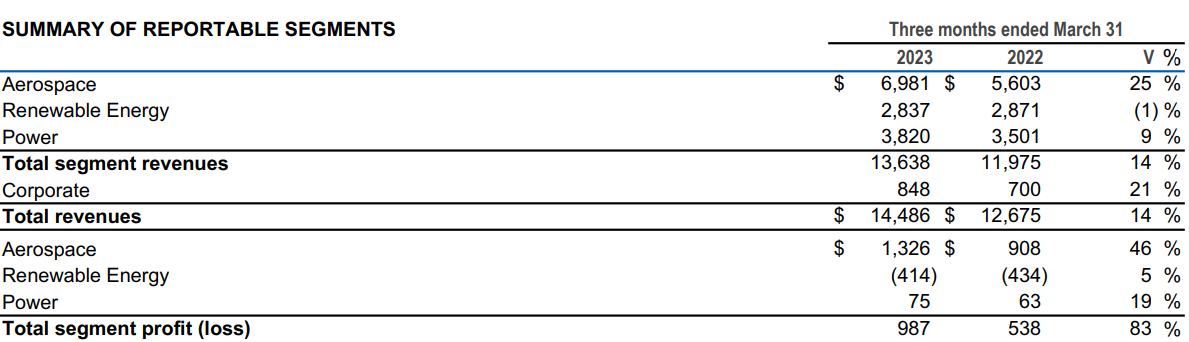

General Electric reports results in three main operating segments, namely Aerospace at 48.2% of Q1 2023 revenue, Renewable Energy at 19.6% and Power at 26.4% of Q1 2023 revenue:

Figure 1: Results breakdown between segments, $ in billions

Source: General Electric Form 10-Q for Q1 2023

Following the successful spin-off of GE HealthCare, the remaining businesses are set to divide into GE Aerospace and GE Vernova (encompassing the gas turbines, grids and renewables business).

Operational Overview

Aerospace was the best performer in Q1 with revenue up 25% Y/Y (2022 +22.2%). Commercial customers were the main driving force behind the increase, with Defense registering a marginal decline. Higher revenues helped push the segment margin up by 2.8% Y/Y to 19%, resulting in a 46% Y/Y increase in segment profit.

Renewable Energy was the only segment to register a sales decline in Q1, down 1% Y/Y (2022 -17.3%). The segment margin improved by 0.5% Y/Y but remained negative at -14.6%. As a result, the operating loss declined by 5% Y/Y.

Power delivered a 9% Y/Y revenue increase in Q1 (2022 -3.8%). The segment margin also improved by 0.2% to 2%, resulting in a 19% rise in segment profit.

On a company level, revenue grew 14% in Q1 (2022 +2.9%), Adjusted EPS was $0.27/share (2022 $0.77/share) and Free cash flow was $0.1 billion (2022 $3.1 billion).

Updated 2023 Outlook

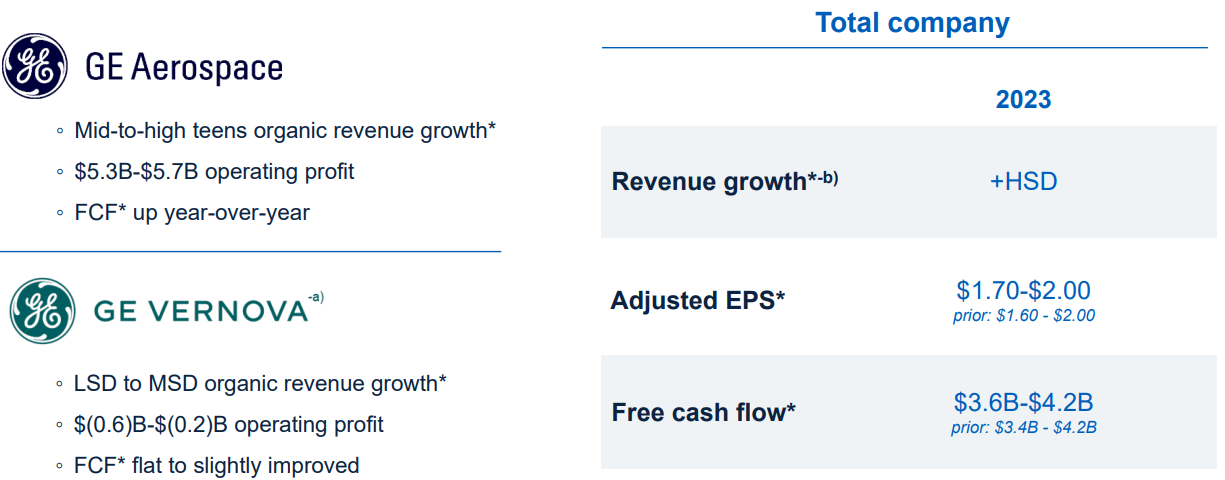

Based on first quarter business performance and market demand, GE raised the low end of its full-year adjusted EPS (+6.3%) and free cash flow (+5.9%) ranges:

Figure 2: General Electric updated 2023 outlook

Source: General Electric earnings presentation for Q1 2023

As a result, adjusted EPS is expected to increase by 240% to $1.70-2.00/share. Free cash flow is seen 23% higher at $3.4-4.2 billion.

Investor Day

GE held its investor day on March 9, highlighting progress made in carving out the remaining two businesses, namely GE Aerospace and GE Vernova.

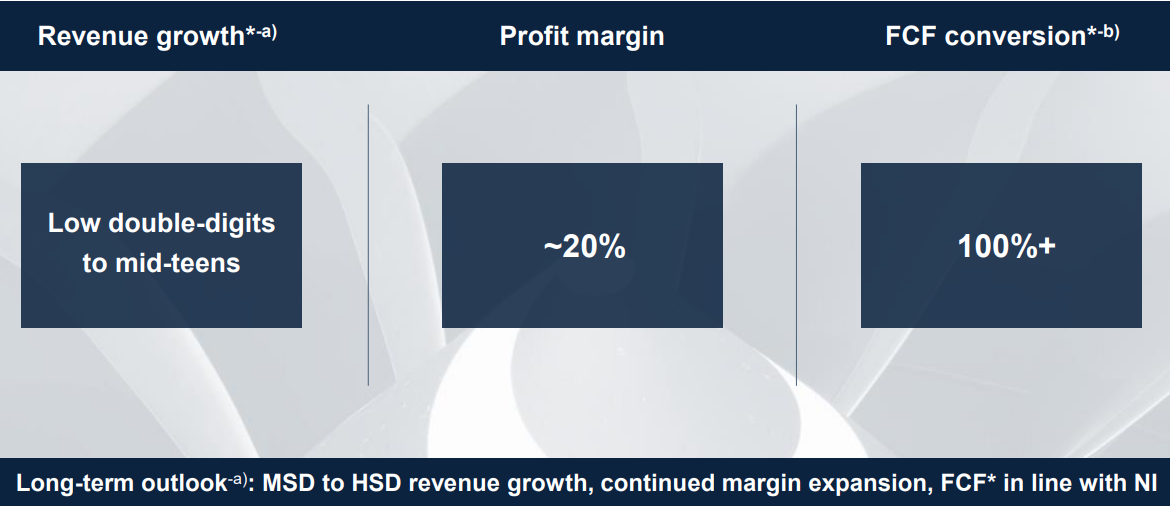

GE Aerospace growth is expected to peak in 2023 as commercial revenue passenger kilometers recover to 2023 levels. In Q1 2023 global commercial departures, a key measure for the commercial engine and services business, were at 97% of 2019 levels. Longer term, the segment is seen growing at mid-to-high single digits (1.5x-2x GDP):

Figure 3: GE Aerospace 2025 Outlook

Source: General Electric 2023 Investor Day presentation

Military engine sales, which accounted for 7% of total Q1 2023 revenues, are seen growing at a high single-digit rate through 2030.

As a result of higher sales, inflation and a 20% margin in 2025, GE Aerospace profits are seen at $7.6-8 billion, some 41.8% higher than the $5.3-5.7 billion expected in 2023.

GE Vernova is still expected to deliver a loss of $0.2-0.6 billion in 2023 before turning a profit starting in 2024. Longer term, the revenue outlook is similar to GE Aerospace but with a significantly lower profit margin:

Figure 4: GE Vernova long-term outlook

Source: General Electric 2023 Investor Day presentation

General Electric Capital Structure

GE ended Q1 with a net debt of $10.4 billion, a relatively conservative amount against its market cap of $110 billion. What's more, the remaining 19.9% GE HealthCare stake is worth about $7.3 billion. GE also holds equity and notes in AerCap valued at circa $4.5 billion. As a result, eventually selling these non-core holdings may move the company to a net cash position.

In Q1, GE received $1.8 billion from its sale of AerCap shares and expects to fully exit the position over time. Likewise, GE also intends to exit GE HealthCare in the coming years, executing sales in an orderly manner.

Conclusion

General Electric's 2023 results will benefit strongly from the commercial air traffic recovery. Looking into 2024, GE Vernova's swing to profitability should provide a good opportunity to spin-off the company, finalizing the plan to split the original GE into three separate companies.

GE benefits from public procurement contracts most visibly from the sale of military aircraft engines (7% of Q1 2023 sales), but also from the services business in GE Aerospace. Last but not least, the grids business within GE Vernova is vital for the energy transition.

Given the dynamic nature of General Electric's government business, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy General Electric or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.