It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. General Electric recently reported its Q2 2023 results and below we will provide a brief analysis of the contractor’s latest performance.

Key points:

* Military engine sales accounted for 8% of GE's Q2 revenues, with orders growing 14.5 times on a year-to-date basis;

* 18% revenue growth in Q2; low-double digit increase expected for the full year;

* Adjusted EPS of $0.68/share, up 89% Y/Y. 2023 outlook raised to $2.10-2.30/share, +285% Y/Y;

* Net debt of $9 billion, with remaining GE Healthcare Technologies 13.54% stake worth $4.7 billion. 2023 free cash flow is seen 40% higher Y/Y at $4.1-4.6 billion;

* Commercial aircraft departures reached 98% of 2019 levels, implying slower growth ahead.

General Electric Q2 2023 Results Overview

We previously covered General Electric's Q1 2023 results in part 28 of our Top Government Contractors series here. Below we will highlight the progress achieved by GE in Q2 of 2023.

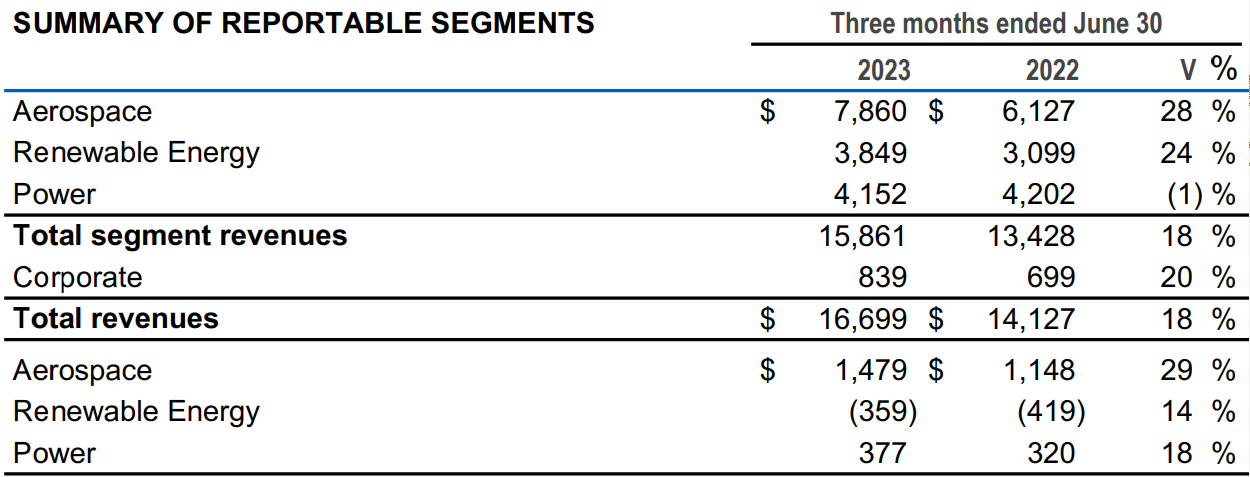

General Electric reports results in three main operating segments, namely Aerospace at 47.1% of Q2 2023 revenue, Renewable Energy at 23% and Power at 24.9% of Q2 2023 revenue:

Figure 1: Results breakdown between segments

Source: General Electric Form 10-Q for Q2 2023

Operational Overview

Aerospace was the best performer in Q2 with revenue up 28% Y/Y (2022 +22.2%). Growth was broad-based, with commercial and defense customers contributing in tandem. Segment margin was up by 0.1% Y/Y to 18.8%, driven by increased volume and prices. As a result, segment profit increased 29% Y/Y in Q2.

Renewable Energy returned to growth in Q2 – sales were up 24% Y/Y (2022 -17.3%) as the equipment business benefited from strong demand at Offshore Wind, Grids in Europe, as well as Onshore Wind in North America. The segment margin improved by 4.2% Y/Y on higher volumes and pricing; nevertheless, it remained negative at -9.3%, with the operating loss down by 14.3% Y/Y.

Power was the only segment to register a 1% Y/Y revenue decline in Q2 (2022 -3.8%) on weakness in Gas Power and Steam Power. Despite the setback, services growth in Gas Power improved the segment margin by 1.5% to 9.1%, resulting in an 18% rise in segment profit.

On a company level, revenue grew 18% in Q2 (2022 +2.9%), Adjusted EPS was $0.68/share, up 89% Y/Y (2022 $0.77/share) on higher operating income and deleveraging. The adjusted profit margin improved by 1.6% Y/Y to 8.8% on higher volume, pricing and productivity. Free cash flow was $0.5 billion year-to-date (2022 $3.1 billion).

During the quarter, GE also recorded a $1 billion non-cash charge related to its legacy mortgage portfolio in Poland via Bank BPH.

Updated 2023 Outlook

Based on stronger performance across Aerospace and Vernova (which will combine the Power and Renewable Energy businesses), GE raised its revenue, adjusted EPS and free cash flow guidance:

Figure 2: General Electric updated 2023 outlook

Source: General Electric earnings presentation for Q2 2023

As a result, revenue should increase by a low double-digit number, adjusted EPS is expected to increase by 285% to $2.10-2.30/share. Free cash flow is seen 40% higher at $4.1-4.6 billion.

CFO Rahul Chai also shared his outlook for Q3 on the conference call:

...expect high single-digit revenue growth in the quarter and then EPS range of about $0.45 to $0.55 with sequential profit growth in both Aerospace and in Renewables. And we will see a pretty strong growth in Power in the third quarter on profit, and expect the margins to go up 3 to 4 points on Power. And if you look at the EPS that we're providing, the range that we're providing of $0.45 to $0.55, that's about 2x what we did last year even if we exclude the charge. So, it's a significant improvement from that.

Capital Structure

GE ended Q2 with a net debt of $9 billion, a very conservative amount against its market cap of $125 billion. During the quarter, GM monetized approximately 32% of its stake in GE HealthCare for total proceeds of $2.2 billion. The remaining 13.54% stake is worth around $4.7 billion.

In Q3, GE plans to redeem its preferred stock for $2.8 billion, simplifying the company's capital structure.

Conclusion

The Aerospace segment most likely had its peak growth in Q2, with GE reporting that global commercial aircraft departures reached 98% of 2019 levels in the quarter, implying slower growth ahead.

Vernova is on track to launch as a separate company sometime in early 2024, with an operating profit moving ever closer on the back of stronger pricing in the Renewables pipeline.

GE benefits from public procurement contracts most visibly from the sale of military aircraft engines (8% of Q1 2023 sales), with orders for defense engines growing 14.5 times on a year-to-date basis (511 in 2023 relative to just 33 in 2022). This bodes well for the services business in GE Aerospace.

Given the growing importance of General Electric's government business, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy General Electric or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.