It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In Part 18 of our blog series, we will present you the latest results of Cardinal Health.

Key points:

* 13.2% Y/Y revenue growth in Q2, driven by gains in Pharmaceutical (+15.2%) and continued decline in Medical (-7.1%);

* Non-GAAP diluted EPS of $1.32/share in Q2, up 4% Y/Y. 2023 guidance boosted to $5.20-5.50 (5.7% higher than 2022);

* $781 million in free cash flow in H1 2023. Full year target unchanged at $1.5-2 billion (down 23.9% on 2022);

* Net debt of just $1.6 billion. $5.89 billion remaining in opioid settlement payments;

* No significant headwind from COVID-19 becoming endemic. Operational normalization set to boost profitability, led by the Medical segment.

Cardinal Health Q2 2023 Results Overview

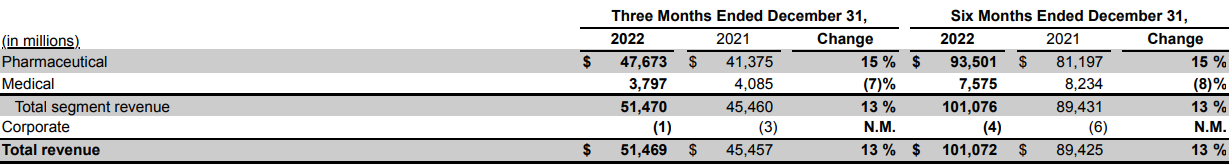

Cardinal Health has a fiscal year ending on June 30. Hence, we will highlight the pharmaceutical distributor's Q2 2023 results for the three months ended December 31. The company divides its operations into two main segments, namely Pharmaceutical (covers branded and generic pharmaceuticals for the U.S. market, as well as a variety of pharma services) at 92.6% of Q2 2023 revenues and Medical (covers Cardinal Health branded products for U.S. and overseas markets, as well as medical and surgical products) at 7.4% of Q2 2023 revenues:

Figure 1: Q2 2023 Cardinal Health segment revenues

Source: Cardinal Health Q2 2023 Form 10-Q

Cardinal Health Operational Overview

Pharmaceutical delivered 15.2% Y/Y revenue growth in Q2, ahead of the 13.5% increase achieved in fiscal 2022. Segment profit grew 8.9% Y/Y, resulting in a lower segment profit margin of 0.97% (1.03% in the prior-year period). Overall, results were driven by brand and specialty pharmaceutical products while inflationary supply chain costs weighed on profitability.

Medical saw its sales decrease by 7.1% Y/Y in Q2, worse than the 4.8% decline in fiscal 2022. Segment profit was down 66% Y/Y, with the segment profit margin cratering to 0.45% (1.22% in the prior-year quarter). Lower volumes and inflation significantly affected results.

On a consolidated basis, revenues grew 13.2% Y/Y in Q2, ahead of the 11.6% increase achieved in 2022. Non-GAAP Operating earnings were $467 million in Q2, flat Y/Y. Non-GAAP diluted EPS was $1.32/share in Q2, up 4% Y/Y. For reference, in fiscal 2022 EPS was down 9% to $5.06/share.

Adjusted free cash flow was $439 million in Q2 and $781 million in H1 '23 (FY 2022 total was $2.3 billion). The major non-cash item in the quarter was a $709 million goodwill impairment in the Medical segment. Naturally the write-off was excluded in non-GAAP results.

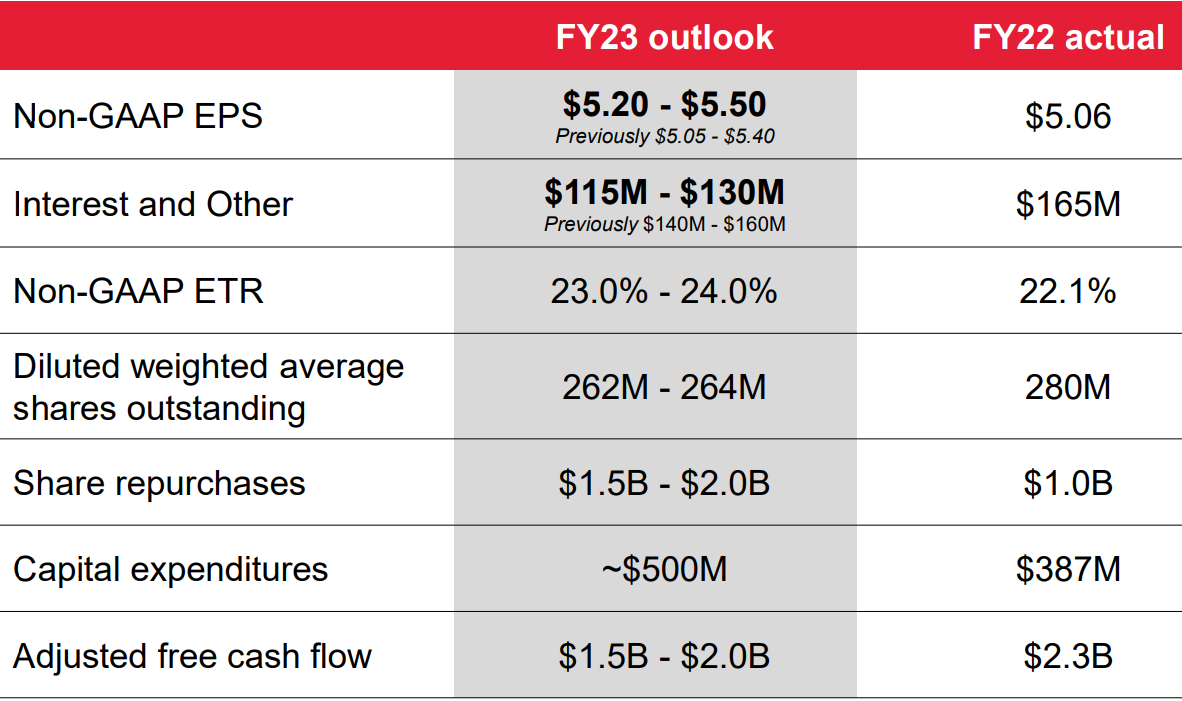

2023 Outlook

Thanks to strength in the Pharmaceutical segment, Cardinal Health boosted its Non-GAAP EPS guidance by 2.4% to $5.20-5.50/share. Fixed interest rates on debt, coupled with elevated cash balances, will result in reduced interest expenses over the near term:

Figure 2: Cardinal Health updated 2023 outlook

Source: Cardinal Health Q2 2023 Results Presentation

The new EPS forecast is about 5.7% higher than the $5.06/share achieved in fiscal 2022.

Despite increased bottom-line guidance, adjusted free cash flow is still seen at $1.5-2 billion, some 23.9% lower than 2022.

Turning to segment performance, Pharmaceutical is set to deliver 13-15% top-line growth, with segment profit increasing 4-6.5%. Medical, on the other hand, is forecast to see a 3-6% sales drop and flat to 20% down segment profit.

Medical Improvement Plan

Cardinal Health is targeting at least $650 million in Medical segment profit by fiscal 2025. For reference, the figure was $216 million in 2022 and $577 million in 2021.

The plan is largely based on mitigating inflation and supply chain issues ($300 million impact on segment profit), as well as growth initiatives for a cumulative $185 million in segment profit. The increased revenue is set to come from Cardinal Health branded products, as well as enhanced technology offerings.

Cardinal Health Capital Structure

Cardinal Health ended 2022 with a net debt of just $1.6 billion, a negligible amount considering the market capitalization of $18.6 billion and strong free cash flow generation. However, the company has an outstanding liability of $5.89 billion related to an opioid distribution settlement in 2022. The amount is to be paid over 17 years.

As highlighted on the conference call, Cardinal Health continues to deploy capital on share repurchases:

Diluted weighted average shares were 263 million, 6% lower than a year ago due to share repurchases. In the second quarter, we completed our $1 billion dollar Accelerated Share Repurchase program and initiated a new $250 million dollar program, resulting in a total of $1.25 billion dollars deployed year-to-date. We continue to expect $1.5 billion to $2 billion dollars in share repurchases in fiscal ‘23, which reflects our continued focus on maximizing shareholder value.

Conclusion

Cardinal Health was not a major beneficiary of COVID-19 medical spending, as highlighted on the conference call:

Specifically to your question around COVID therapies and vaccines, you have it, your inclination is correct. We participated very little on any of that. Over the pandemic, frankly, we've had more of a headwind than a tailwind because of the volume impacts on our underlying utilization. Of course, we're all the way through that at this point in time and have been so for about a year. So we're at a very normalized level at this stage.

Thus, the company is in a unique position to benefit from the endemic phase of the pandemic. Furthermore, profitability improvements in the Medical segment represent low hanging fruit for the company as it strives to optimize its operational performance.

The company will hold an Investor Day on June 8. Cardinal Health will outline how further growth in the Pharmaceutical segment, coupled with a stabilized Medical segment, will drive bottom-line performance.

Monitoring the company’s public procurement activity also remains a smart move that can provide key insights into Cardinal Health’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Cardinal Health or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.