It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. AmerisourceBergen recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s performance between January and March of 2023.

Key points:

* 9.9% sales growth in Q2 2023. Full year revenues seen 7% higher;

* Q2 adjusted EPS up 8.7% to $3.50/share. Full year guidance hiked by 1.5% to $11.80/share, up 7% from 2022;

* $685 million to be paid for a 35% stake in OneOncology, bringing YTD M&A to $2.1 billion, 5% above $2 billion free cash flow target;

* Expense growth to slow into H2 2023, helping margins;

* Net debt of only $3.4 billion. Share count down 3.6% Y/Y.

AmerisourceBergen Q2 2023 Results Overview

We originally covered AmerisourceBergen (which is in the process of changing its name to Cencora)'s Q1 2023 results in part 16 of our Top Government Contractors series here. As the company has a fiscal year ending in September, below we will highlight the progress achieved in Q2 2023.

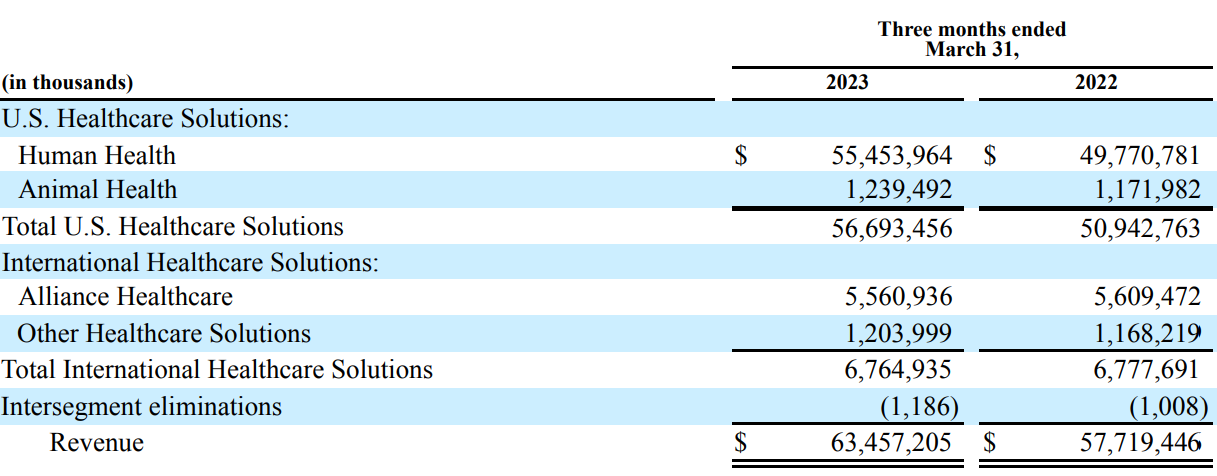

AmerisourceBergen reports results in two main segments, namely U.S. Healthcare Solutions at 89.3% of Q2 2023 sales and International Healthcare Solutions at 10.7% of Q2 2023 sales:

Figure 1: Q2 2023 AmerisourceBergen segment revenues

Source: AmerisourceBergen Q2 2023 Form 10-Q

Operational Overview

U.S. Healthcare Solutions was the top performing segment in Q2, increasing revenue 11.3% Y/Y (2022 +4.8%). Growth was driven by unit volumes, as well as specialty products to physician practices and health systems. The operating income margin development was less favourable, down 0.1% to 1.33%, resulting in a 3.6% Y/Y increase in operating profit.

International Healthcare Solutions sales were down 0.2% Y/Y in Q2 (2022 +129.8% on M&A). Sales weakness spread to operating income margins, down 0.16% to 2.6%, with operating profit decreasing 5.9% Y/Y. The lacklustre results were due adverse foreign exchange effects on the European distribution business.

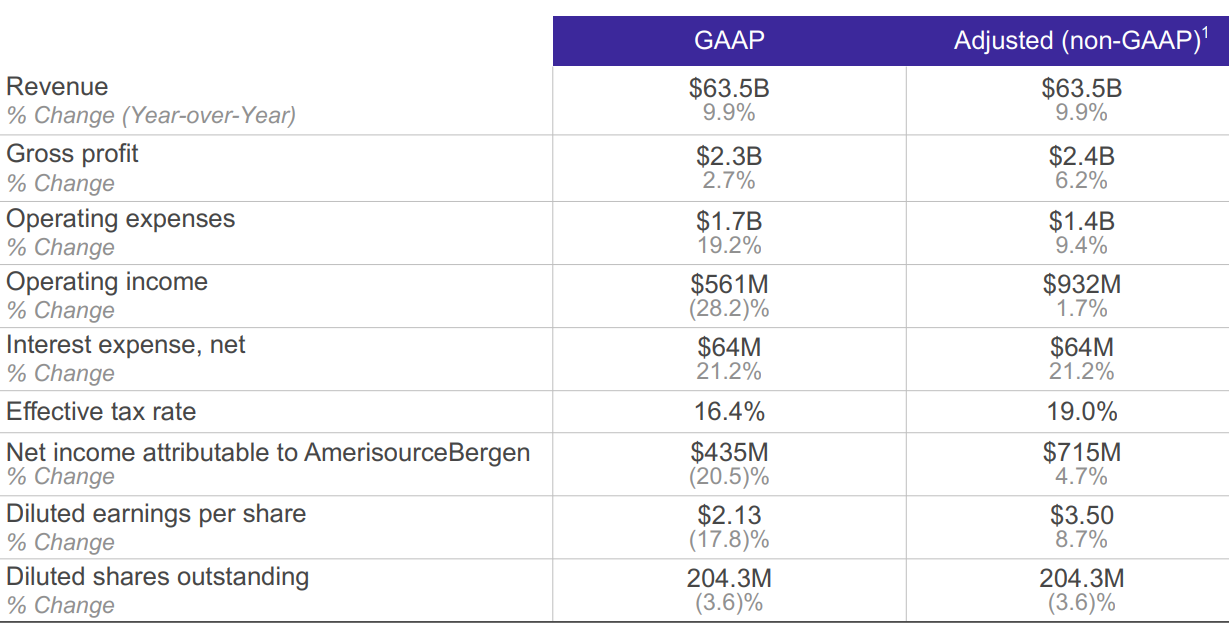

On a consolidated basis, sales grew 9.9% Y/Y in Q2 (2022 +11.5%). Adjusted Diluted EPS was $3.50/share in Q2, up 8.7% Y/Y (2022 +19.1% to $11.03/share):

Figure 2: AmerisourceBergen Q2 2023 results

Source: AmerisourceBergen Q2 2023 Results presentation

Dollar strength subtracted 1% of topline growth. Adjusted free cash flow came in at $1.1 billion in the first 6 months, in line with the company's $2 billion 2023 target.

Updated 2023 Outlook

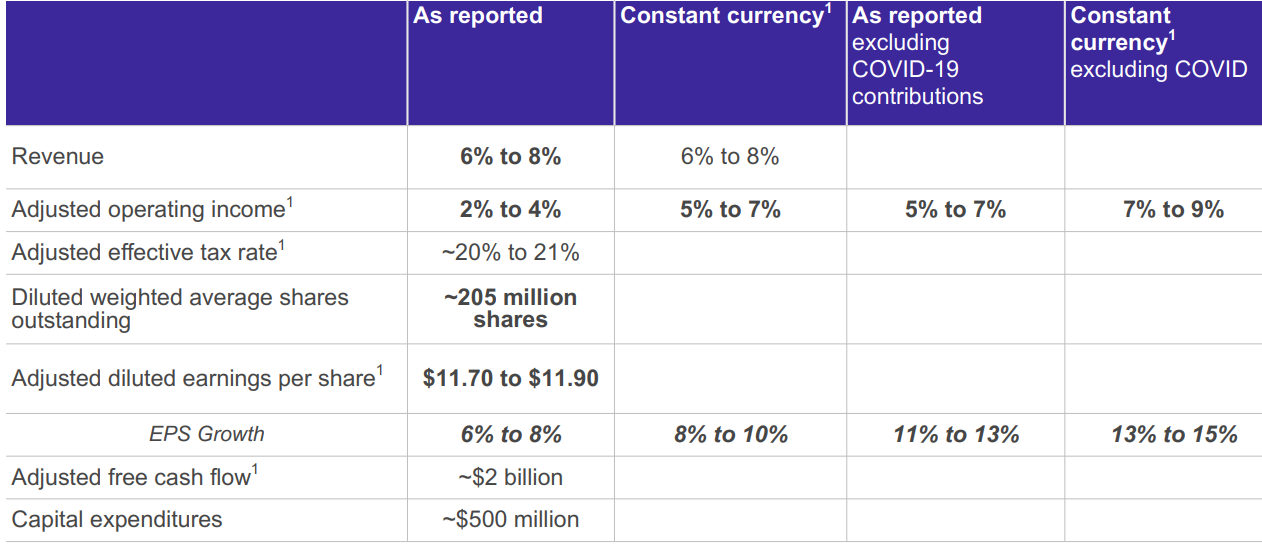

Relative to Q1 guidance, the company boosted its revenue and operating income outlook by 1%, resulting in a 1.5% higher EPS range of 11.50-11.90/share, driven in part by a 0.5% greater decrease in the share count:

Figure 3: AmerisourceBergen updated 2023 guidance

Source: AmerisourceBergen Q2 2023 Results presentation

From a division perspective, the upgrade was motivated by a stronger performance in the U.S. Healthcare Solutions segment.

Looking into H2 2023, CFO Jim Cleary was optimistic on margin improvement:

As we have called out previously, in the second half, we will lap the inflationary pressures that began in the prior year March quarter. We will see operating expense growth slow significantly, particularly in the fourth quarter, due in part to incremental expense management actions taken, which put us on track to have a more normal growth rate in the mid-single-digit percent range for the full year.

Capital Structure

AmerisourceBergen ended Q2 with a net debt of only $3.4 billion, a conservative amount against its market capitalization of $38 billion and strong free cash flow generation.

Diluted weighted average shares outstanding for the second quarter of fiscal 2023 were 204.3 million, a decrease of 7.7 million shares, or 3.6% versus the prior fiscal year quarter, primarily as a result of share repurchases.

OneOncology investment

Post quarter end, on April 20, 2023, AmerisourceBergen and TPG, a global alternative asset management firm, announced an agreement to acquire OneOncology, a network of leading oncology practices. AmerisourceBergen will invest approximately $685 million (representing circa 35%) in a joint venture formed to acquire OneOncology for around $2.1 billion, and TPG will acquire the majority interest in the joint venture. CEO Steve Collis highlighted the strategic rationale for the deal:

Most recently, we announced our agreement to invest in OneOncology, a network of leading community oncologists with 900 affiliated providers across 14 states. This investment will deepen and enhance our strong ties to community providers. And OneOncology's practice management services are complementary to AmerisourceBergen's existing capabilities in inventory management, practice analytics and clinical trial support. We know OneOncology and its members well, with many of the physicians serving as advisers to ION and with AmerisourceBergen having served many of these practices for over two decades. Our future plans for collaboration with OneOncology include opportunities for sharing key insights to enhance the value we are able to provide all our community oncology partners as we look to a future with data, analytics and value-based contracting will play an even greater role in community oncology.

The transaction is expected to close by September 2023.

Conclusion

AmerisourceBergen is enjoying strong operating momentum, successfully absorbing the downturn in COVID-19 earnings. At the same time, following the PharmaLex and OneOncology acquisitions, the company will have spent $2.1 billion, or 5% more than its expected 2023 free cash flow, on selective M&A deals.

As a result, in 2024, the company should benefit from a smaller foreign exchange drag, a more limited COVID-19 earnings drop to absorb, as well as the full-year effect of acquisitions. This will power EPS growth even if revenue performance is not as robust.

Given the evolving revenue outlook for AmerisourceBergen as it expands its presence in services, monitoring the company’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Humana or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.