It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Accenture recently reported its Q4 2023 results and below we will provide a brief analysis of the company’s performance.

Key points:

* Around 13.5% of Q4 revenue was awarded by public sector payers.

* 3.6% Y/Y revenue growth rate in Q4. Fiscal 2024 outlook set at +3.5%.

* Adjusted EPS of $2.71/share in Q4, +4% Y/Y. 2024 initial expectations set at $11.97-12.32/share, up 4.1% Y/Y.

* 2.3% Y/Y free cash flow growth to $9 billion in 2023. Fiscal 2024 cash generation seen flat at $9 billion.

* New bookings in Q4 down 3.8% Q/Q and 10% Y/Y, with a book-to-bill ratio of 1.00 in Q4 and 1.1 in 2023.

Accenture Q4 2023 Results Overview

Accenture delivers professional services in five main segments, called Industry groups. The company has a fiscal year ending on August 31. We previously covered Accenture's Q3 results in part 44 of our Top Government Contractors series here. Below we will highlight the progress achieved in Q4 2023 and see what plans the company has for fiscal 2024.

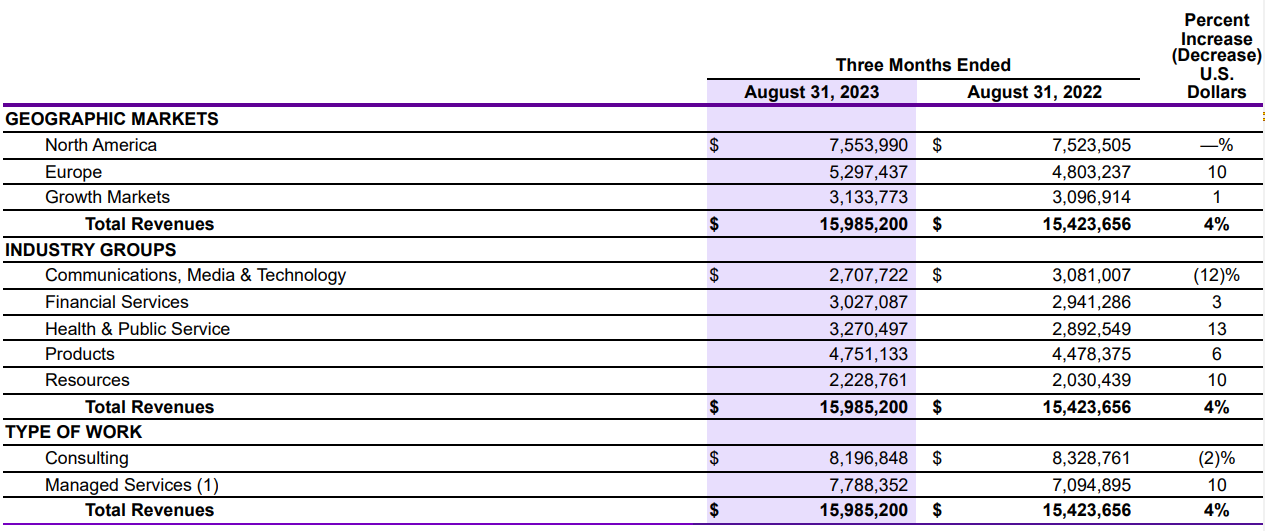

Ranked from largest to smallest, the Industry groups are:

- Products (customers in consumer goods, industrial and life sciences) at 29.7% of fiscal Q4 2023 revenues;

- Health & Public Service at 20.5%;

- Financial Services at 18.9%;

- Communications, Media & Technology at 16.9%;

- Resources (customers in chemicals, natural resources, energy and utilities) at 13.9% of fiscal Q4 2023 revenues:

Figure 1: Fiscal Q4 2023 Accenture Industry group results

Source: Accenture form 8-K for Q4 fiscal 2023

Within the Health & Public Service segment, some 66% of fiscal 2022 revenues were in the Public sector, while the rest were in the Health sector. As a result, around 13.5% of total Q4 2023 Accenture revenues were awarded by public sector payers. CEO Julie Sweet highlighted the work the company is performing for government contractors:

Accenture Federal Services is helping the Defense Health Agency operate and enhance the joint medical common operating picture platform. By implementing data synchronization across multiple network domains and near real-time collaboration and information sharing, we will provide a comprehensive picture into Department of Defense medical assets. This increases visibility into unit health, equipment and supplies; and allows for faster and more informed decision-making.

Operational Overview

In contrast to previous quarters, USD strength was not a factor in Q4 reported performance, with underlying local currency results converging with reported USD results.

Products saw its sales increase 6.1% Y/Y in Q4 (2023 +4.5%).

Health & Public Service was the best performing industry group, increasing sales 13.1% Y/Y in Q4 (2023 +11.9%).

Financial Services revenue was up 2.9% Y/Y in Q4 (2023 +2.7%).

Communications, Media & Technology was the only contracting industry group in the quarter, down 12.1% Y/Y (2023 -6.1%). The slump in Q4 revenues was almost double the year-to-date average decrease of 6.1%.

Resources was the second-best performer in Q4, with sales up 9.8% Y/Y (2023 +9.6%).

From the industry group results above we can conclude that Q4 performance saw an acceleration of trends which were present throughout 2023, with all sectors except Communications, Media & Technology reporting higher Y/Y growth rates.

On a consolidated basis, sales increased 3.6% Y/Y in Q4 (2023 +4.1%). Adjusted EPS was $2.71/share, up 4% Y/Y. (2023 $11.67/share, +9% Y/Y). EPS outperformed sales thanks to a 0.2% operating margin gain. Free cash flow was $3.2 billion in Q4 (2023 $9 billion, +2.3% Y/Y).

2024 Outlook

Given the mixed results across industry groups in Q4, Accenture issued a downbeat Q1 2024 forecast, with revenue expected to be flat Y/Y in local currency and up 2.5% in reported USD terms.

For the rest of 2024, the company is more optimistic:

Revenue growth is expected to reach 3.5%, with no significant FX headwinds expected;

Adjusted operating margin 15.6%, up 0.2% Y/Y;

Adjusted EPS of $11.97-12.32/share, up 4.1% Y/Y;

Free cash flow of $8.7-9.3 billion, flat Y/Y;

New Bookings

Accenture marked new bookings in the quarter of $16.6 billion, down 3.8% from Q3 and a decrease of 10% relative to the prior-year quarter. As a result, the book-to-bill ratio was 1.00 in Q4 (2023 1.10).

Capital Structure

Accenture is sitting on a net cash position of $9 billion, making it one of the most conservative companies in our Government Contractors series. The market capitalization stands at $198 billion.

Year-to-date, the company has spent $7.2 billion on shareholder remuneration from $9 billion in free cash flow. For 2024, the company expects to increase shareholder payouts, targeting at least $7.7 billion in dividends and buybacks.

Accenture was also active on the M&A front, allocating $2.5 billion across 25 acquisitions in 2023.

Conclusion

Accenture reported decelerating sales growth in Q4 due entirely to the Communications, Media & Technology industry group, with all other segments seeing a pick-up in operating momentum.

The company is set to have a slow start to 2024 in terms of revenue growth before accelerating later in the year. Despite expectations for flat free cash flow growth, Accenture is set to boost shareholder payouts by 7% to at least $7.7 billion.

The company is seeing the effects of its business optimization actions earlier than expected, leading to continued margin expansion in 2024. As a result, despite areas of weakness, 2024 is set to be another growth year for the company.

In light of the fact that around 13.5% of Accenture revenues were derived from the public sector, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Accenture or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.